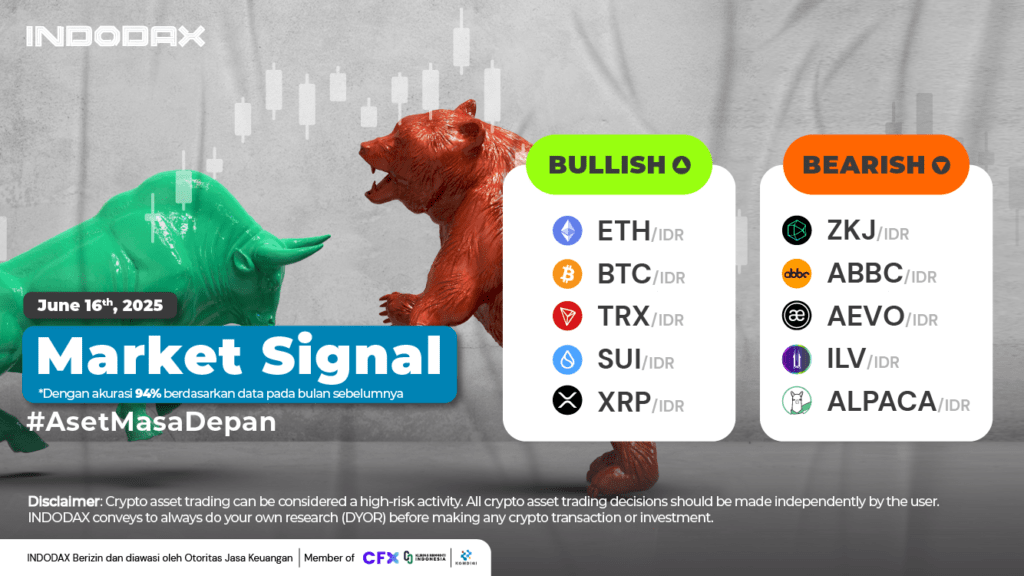

This week, the bullish crypto lineup is led by Ethereum(ETH) in first place, followed by BITCOIN(BTC) and TRON(TRX).

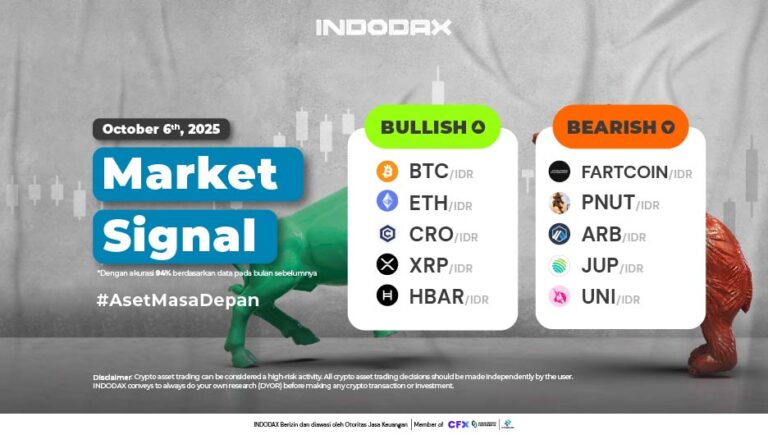

Want to know how your favorite crypto asset is performing? Check INDODAX Market Signal below!

5 Bullish Crypto Assets

1.Ethereum (ETH)

Ethereum (ETH) resistance is indicated to be in the range of 46,000,000 – 49,500,000. The realization of a candle that strengthens beyond resistance will be positive for the change in the Ethereum (ETH) trend in the Bullish zone.

2.Bitcoin (BTC)

Positive trend changes are still indicated to occur in Bitcoin (BTC) with the current trend still holding on to move above WMA/75 and WMA/85, with the Support area in the range of 1,500,000,000 – 1,800,000,000.

3.Tron (TRX)

Tron (TRX) weakening is in line with the negative intersection of both MACD indicator lines. EMA/200 will be penetrated by the failure of the Candle to hold above the Support area of ??4,150 – 4,400.

4.Sui (SUI)

The weakening of Sui (SUI) is one of the causes of Candle’s failure to penetrate the Resistance area of ??65,000 – 75,000, which makes the weakening of Sui (SUI) realized and allows Bullish to experience negative pressure.

5.XRP (XRP)

Strengthening is held back by WMA/85 and vice versa, the weakening of XRP (XRP) is still waiting for confirmation from EMA/200, making the XRP (XRP) trend take time to determine the next direction, Resistance is in the range of 40,000 – 50,000.

5 Aset Kripto Bearish

1.Polyhedra Network (ZKJ)

There was a significant weakening in Polyhedra Network (ZKJ), confirming the Bearish trend that occurred and Polyhedra Network (ZKJ) touched its latest lowest price on Indodax.

2.ABBC (ABBC)

The trend moves in the Sideways Bearish phase causing the price to move in a fairly limited range of 25 – 50, passing one of the prices will have an impact on changing the ABBC trend (ABBC).

3.Aevo (AEVO)

The weakening is still projected to continue by Aevo (AEVO) with the Candle currently unable to move from WMA/85 with the trend still moving in the Bearish zone.

4.Illuvium (ILV)

Using the 1 Day chart time, it is indicated that Illuvium (ILV) had strengthened and improved the trend with Candles successfully staying above EMA/200 but this did not last long with Candles that did not penetrate 1,200,000 – 1,450,000.

5.Alpaca Finance (ALPACA)

On the 1 Day chart, Alpaca Finance (ALPACA) has been identified as entering the Bearish zone since May 27, 2025 with the price of Alpaca Finance (ALPACA) having weakened by more than 50%. The price will be able to be improved by strengthening Alpaca Finance (ALPACA) towards the 1,100 – 2,000 area.

NOTE: If the 5 EMA crosses the WMA 75, 85 and 200 EMA lines and the lines intersect from the bottom up, then the market trend tends to go up (bullish), each table above shows that if the 5 EMA value is higher than the 75.85 WMA and 200 EMA, the market tends to go up (bullish).

If the RSI and MACD values ??show the same condition, it means that the market is showing the same trend. Overbought or oversold conditions are an indicator that the market is already at the point of changing direction of a trend.

ATTENTION: All contents which includes text, analysis, predictions, images in the form of graphics and charts, as well as news published on this website, is only used as trading information, and is not a recommendation or suggestion to take action in transacting either buying or selling. certain crypto assets. All crypto asset trading decisions are independent decisions by the users. Therefore, all risks arising from it, both profit and loss, are not the responsibility of Indodax.

Polkadot 10.35%

Polkadot 10.35%

BNB 0.3%

BNB 0.3%

Solana 5.08%

Solana 5.08%

Ethereum 1.84%

Ethereum 1.84%

Cardano 1.25%

Cardano 1.25%

Polygon Ecosystem Token 1.94%

Polygon Ecosystem Token 1.94%

Tron 2.39%

Tron 2.39%

Market

Market