Hello Indodax friends! Here are 5 bullish and bearish crypto assets that can be used as a reference in determining which crypto assets you can buy or sell. We have Monero which has been on an uptrend phase for quite a while. Let’s check them out!

5 Bullish Crypto Assets

-

Conflux (CFX)

The MACD indicator indicates that the movement of CFX/IDR has moved in a positive direction, where the breakout of this indicator occurred on April 14 – 15 2022. With a 4-Hour timeframe, Conflux (CFX) has experienced an overbought phase that occurred on April 16, 2022, which can be seen on the RSI indicator.

If it weakens or is corrected, then it will test the support level at the price range of 2,500 – 2,600.

-

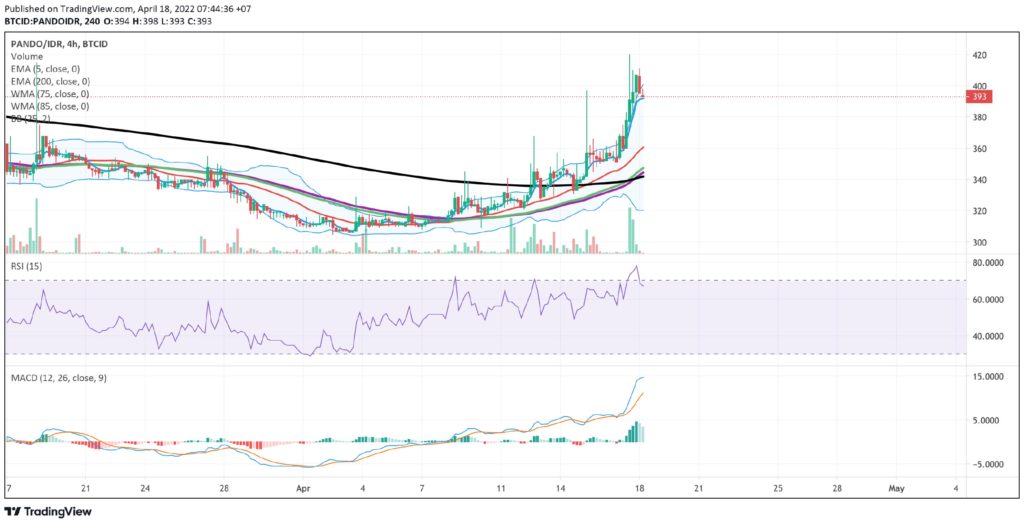

Pando (PANDO)

Pando (PANDO) experienced quite volatile and dynamic movements. This happened because Pando (PANDO) went into an uptrend phase, after previously hitting the lowest at 305 price level which occurred on April 2, 2022 and after touching that price level Pando (PANDO) experienced a strong rebound.

The RSI indicator has shown the Overbought phase where this indicates that the price has touched the highest price since March 05, 2022.

-

Monero (XMR)

Bullish and uptrend phase of Monero (XMR) has been ongoing for quite a while, starting from March 08, 2022 – March 10, 2022. This uptrend phase occurs because Monero (XMR) has touched its lowest at the price level of 1,888,400 – 1,888,500 then after touching that level, Monero (XMR) rebound and turned bullish.

This strengthening will test the resistance level, which is quite strong at the price level of 3,900,000.

-

Dao Maker (DAO)

On 12 April 2022 DAO/IDR hit the price level of 34,000 which turned out to be a reversible momentum into an uptrend phase. The price increase will test the resistance level, which is in the price range of 50,000 – 51,000.

-

DAEX (DAX)

It can be seen that DAEX (DAX) with a 4-Hour time frame experienced a rebound after touching the price range of 99, which occurred on April 05, 2022 and this happened again on April 12, 2022. In this time frame, price axes often occur on the chart.

From the MACD indicator, it can be seen that DAX/IDR is experiencing sideways because there is a narrowing between the two lines.

5 Bearish Crypto Assets

-

Bitcoin Diamond (BCD)

Bitcoin Diamond (BCD) has entered a Downtrend phase for quite a while; it has entered this phase from October 24, 2021 – October 26, 2021. The Downtrend phase is marked by the crossing of the 5 EMA below the 200 EMA, which is also followed by a downward crossing of the 75 WMA and WMA 85. MACD and RSI indicators will confirm the next trend direction movement.

-

Neo (NEO)

If it is drawn on the price movement chart a while ago and using the 1-Day Time frame, it can be seen that Neo (NEO) has entered a Bearish phase since October 20, 2021. It has entered a bearish phase for quite some time, it will test a fairly deep support level in the price range of 2,000,000 – 2,460,000.

If you use other indicators such as the MACD indicator, it will show the opposite movement, considering that NEO/IDR has experienced a deep price decline and there is a potential for a reversal.

-

Perpetual Protocol (PERP)

After hitting its highest price on April 4, 2022, the Perpetual Protocol (PERP) experienced a reverse direction towards the downtrend phase instead. This phase is marked by the weakening of EMA 5, WMA 75, WMA 85 thus cutting below the 200 EMA. This decline will test the 52,300-price level.

The MACD indicator shows that the upward line has crossed, which means the PERP/IDR price trend is pointing in a positive direction.

-

saffron.finance (SFI)

saffron.finance (SFI) was going to break through the resistance and breakout lines to form a new trend on April 10, 2022, but failed, because the price level was unable to penetrate that level. Instead it reversed direction, which made saffron.finance (SFI) is in a bearish phase.

If SFI/IDR strengthens and moves in a positive direction, it will test the price of 2,049,000, if this level is broken then it will test the price above it which is in the price range of 2,180,000 – 2,200,000.

-

The Graph (GRT)

When viewed with a 4-hour time frame, The Graph (GRT) touched its highest level in the price range of 7,900 on April 2, 2022, but after touching this level, The Graph (GRT) actually reversed direction with a fairly deep price decline.

GRT/IDR on the RSI indicator is moving towards Oversold, as well as MACD so that the price chart movement still takes some time to confirm. If GRT/ID continues to experience correction, it will test the support level at 4,590 – 4,400.

NOTE: If the 5 EMA crosses the WMA 75, 85 and 200 EMA lines and the lines intersect from the bottom up, then the market trend tends to go up (bullish), each table above shows that if the 5 EMA value is higher than the 75.85 WMA and 200 EMA, the market tends to go up (bullish).

If the RSI and MACD values ??show the same condition, it means that the market is showing the same trend. Overbought or oversold conditions are an indicator that the market is already at the point of changing direction of a trend.

ATTENTION: All contents which include text, analysis, predictions, images in the form of graphics and charts, as well as news published on this website, is only used as trading information, and are not a recommendation or suggestion to take action in transacting either buying or selling. certain crypto assets. All crypto asset-trading decisions are independent decisions by the users. Therefore, all risks stemming from it, both profit and loss, are not the responsibility of Indodax.