Bullish and bearish crypto assets still show the same trend as the previous edition of Indodax Market Signal. The rise and fall of crypto assets will continue for the next week.

This can be seen from crypto-assets that show an upward trend in prices from the Indodax team’s technical analysis. This is certainly good news for those of you who hold ADA, COMP, and several other crypto assets.

Especially some DeFi crypto assets which are allegedly going to increase over the next week.

In addition, Ethereum and Bitcoin are still showing a sideways trend. Both are not in a bullish market and also a bear market.

So, what crypto assets are bullish and bearish this week? Let’s take a look at 5 crypto assets that are bullish and bearish in this week’s edition of Indodax Market Signal.

5 Crypto Assets will be Bullish on This Week

One of the bullish crypto assets is Cardano (ADA). The increase in ADA also continues this week.

Cardano is a “third generation blockchain.” The main goal of this platform is to implement all the best features of Litecoin, Bitcoin and Ethereum into one cryptocurrency; complement the resulting mix with a number of additional innovative technologies.

ADA’s lowest price today is IDR 20,000 and the highest price is IDR 21,400.

.

Chart ADA/IDR

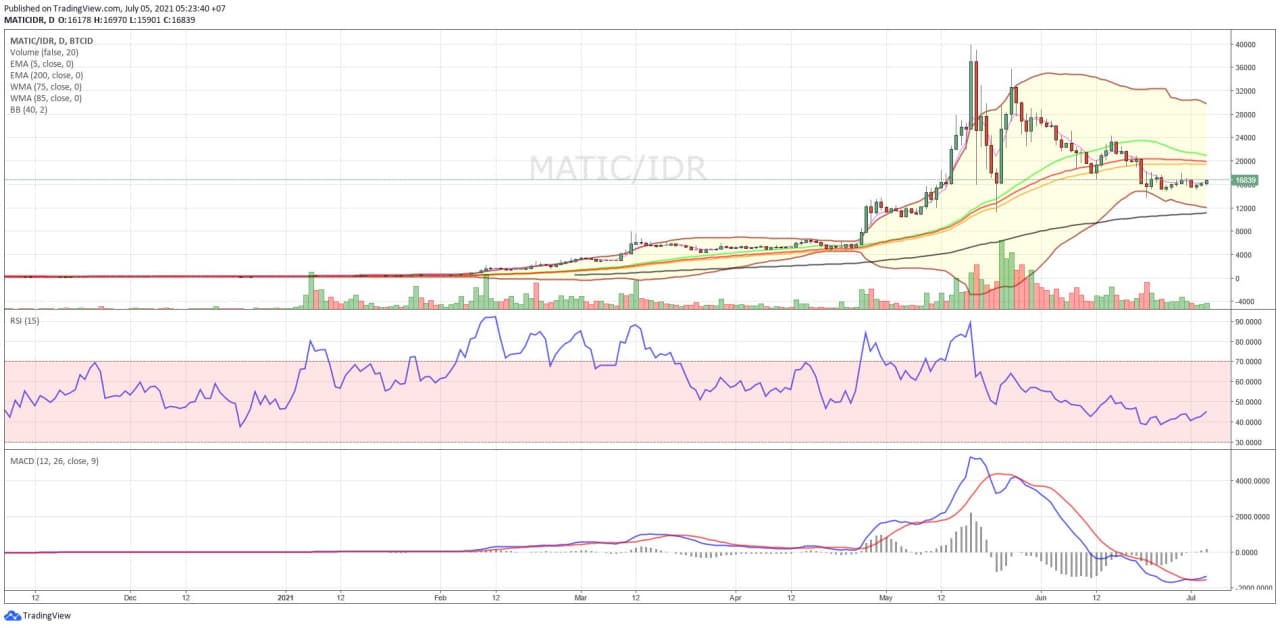

- Polygon (MATIC)

Next, there is the Polygon crypto asset (MATIC) which will experience a price increase in the next week. This increase also continued from the increase in the previous few weeks.

There are several moments that make investors interested in this cryptocurrency. One of the scheduled events is XEND/MATIC integration. Then there are also several other events in early July.

Matic aims to change this by leveraging a combination of blockchain scaling, platform and developer tools, and a sharp focus on user experience.

The lowest price for MATIC today is Rp. 15,901 and the highest price is Rp. 16,970.

Chart MATIC/IDR

- Compound Finance (COMP)

Third, there is the COMP crypto asset. This cryptocurrency actually increased last week, although last week it was not included in Indodax Market Signal.

Compound is a protocol on the Ethereum blockchain that defines a money market, which is a pool of assets with an algorithmically derived interest rate, based on the supply and demand of assets.

Suppliers (and borrowers) of assets interact directly with the protocol, generating (and paying) floating interest rates, without having to negotiate terms such as maturity, interest rates, or guarantees with partners or counterparties.

On this day, the lowest price for COMP is IDR 5,359,445 and the highest is IDR 6,750,000.

Chart COMP/IDR

- AAVE

Next, AAVE will rise over the next week. Unlike the previous crypto assets, AAVE actually reversed direction compared to one week ago. Because last week, he experienced a decline and entered a bear market.

Aave describes itself as a decentralized, open-source, and non-custodial money market protocol. Depositors earn interest by providing liquidity to the lending pool while borrowers obtain excessive collateralized loans from this liquidity pool.

On this day, the lowest price of AAVE is IDR 3,605,000 and the highest price is IDR 4,247,000.

Chart AAVE/IDR

Lastly, there is Uniswap (UNI) which is a DeFi crypto asset. UNI is expected to increase this week.

Uniswap aims to keep token trading automated and fully open to anyone holding tokens, while increasing trading efficiency compared to traditional exchanges.

Uniswap creates more efficiency by solving liquidity problems with automated solutions, avoiding the problems that plagued the first decentralized exchanges. In today’s trading, UNI’s lowest price was Rp.271.700 and the highest was Rp.330.000.

Chart UNI/IDR

5 Crypto Assets will be Bearish on This Week

- Theta Fuel (TFUEL)

Indodax Market signal also discusses crypto assets that will be bearish. First there is TFUEL which may be going down for a week. This decline continued the decline in the previous week.

It is natural for TFUEL to enter a saturated market because it has been showing price increases for several weeks.

TFUEL is used to support on-chain operations such as payments to relays to share video streams, or to deploy or interact with smart contracts. Relayers get TFUEL for every video stream they relay to other users on the network. You can think of Theta Fuel as the “gas” of the protocol.

Today, the price of TFUEL is at the lowest level of Rp5,242 and the highest price of Rp5,141.

Chart TFUEL/IDR

- Theta (THETA)

The crypto asset that entered the next bear market is THETA. This cryptocurrency will show price weakness this week.

This is also in line with the decline in TFUEL prices. Both tend to be the same, although last week, THETA did not enter a bear market.

Theta is a decentralized open source video delivery network with its own blockchain. Theta aims to solve the problems of the existing video streaming market in the industry by using its blockchain technology. So, it is designed to incentivize bandwidth sharing, attracting users to actively attend and work for the Theta video streaming ecosystem.

THETA’s lowest price is IDR 87,500 today. While the highest price is Rp. 94,088.

Chart THETA/IDR

- Energi (NRG)

Next, there is the NRG crypto asset which experienced a decline in price this week. Apparently, investors should move to other crypto assets and leave the DOT so that demand drops.

Energi (NRG) is a next generation Proof of Stake (PoS) cryptocurrency. Powered by the Energi blockchain, NRG combines Ethereum smart contract compatibility with self-funding treasuries, decentralized masternode governance, and Layer 1 and Layer 2 protocols.

NRG also serves as a governance token replacement for the Energiswap decentralized exchange. Today, NRG moved at the lowest level of Rp21,700 and the highest price of Rp23,200.

Chart NRG/IDR

- Nervos (CKB)

Next is the CKB crypto asset that will experience a decline in price. It looks like CKB will be left behind by investors and the crypto community for a while.

The Nervos Network describes itself as an open source public blockchain ecosystem and protocol suite. Nervos CKB (Common Knowledge Base) is a layer 1, proof-of-work public blockchain protocol of the Nervos Network.

It reportedly allows any crypto asset to be stored with the security, immutability and permissions of Bitcoin nature while enabling smart contracts and layer 2 scaling. It aims to capture the total value of the network through the design of the “store of value” crypto economy and native token, CKByte.

On this day, CKB moved with the lowest price of Rp. 173 , and the highest price of Rp. 180.

Chart CKB/IDR

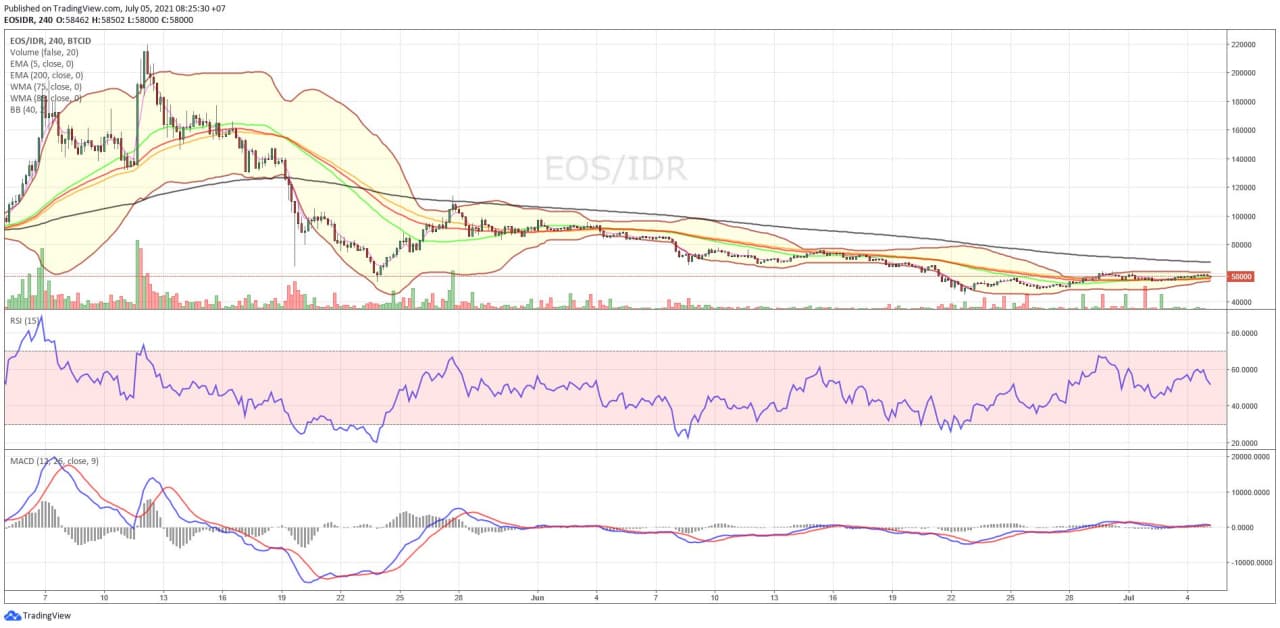

- EOS

Lastly, the crypto asset that has experienced a decline is EOS. EOS is a platform designed to allow developers to build decentralized applications or DApps.

The project’s goal is relatively simple: make it as easy as possible for programmers to embrace blockchain technology — and ensure that the network is easier to use than its rivals. As a result, educational tools and resources are provided to support developers who want to quickly build functional applications.

Other priorities include providing a greater degree of scalability than other blockchains, some of which can only handle less than a dozen transactions per second.

EOS sold for IDR 57.004 the lowest in today’s trading. While the highest price reached Rp. 59,999

Chart EOS/IDR

Indodax Market Signal NOTE: If the 5 EMA crosses the WMA 75, 85 and 200 EMA lines and the lines intersect from the bottom up, then the market trend tends to go up (bullish),

in each table above shows if, the value of EMA 5 is higher than WMA 75.85 and EMA 200 then the market tends to go up (bullish).

If the RSI and MACD values show the same condition, it means the market is showing the same trend, overbought (overbought) or oversold (oversold) conditions are an indicator that the market is already at the point of changing trend direction.

ATTENTION: All content which includes text, analysis, predictions, images in the form of graphics and charts, as well as news published on this website, is only used as trading information, and is not a recommendation or suggestion to take an action in a transaction, either buying or selling. certain crypto assets. All crypto asset trading decisions are independent decisions by the user. Therefore, all risks arising from it, both profit and loss, are not the responsibility of Indodax.