Bitcoin has again touched its highest level in history. In fact, it almost touched Rp. 500 million at the end of last week. So Bitcoin is still a bullish crypto asset this week.

Crypto assets will be bullish from January 4, 2021 – January 10, 2021, still the same as the previous assets. However, this week, Dogecoin (DOGE) is still included in the crypto asset line that will be bullish.

Ripple (XRP) is predicted to be a bearish asset this week. This is because XRP experienced a fantastic price drop last week. The decline occurred because the majority of crypto asset brokers in the United States delisted the XRP coin.

This came after the US Securities and Exchange Commission (SEC) stated that XRP was in breach of securities regulations.

Another crypto asset that is predicted to be bearish is USDT this week. So what are the bullish and bearish crypto assets on the Indodax market this week? Check out the reviews

5 Bullish Crypto Assets This Week

- Bitcoin (BTC)

Bitcoin is a crypto asset that will experience a bullish or rising price this week. The price of Bitcoin has remained at its highest level since November 2020.

The driving factor for Bitcoin price is the massive demand that continues. People believe that Bitcoin has proved a fantastic increase in price throughout 2020.

Many analysts predict that the Bitcoin price increase will also occur in 2021. The increase in price is predicted to be seen over the next one week.

Apart from being flooded with demand, Bitcoin will also experience supply restrictions this year. So that the price will be more stable.

The halving day in May 2020 will only have an impact in 2021.

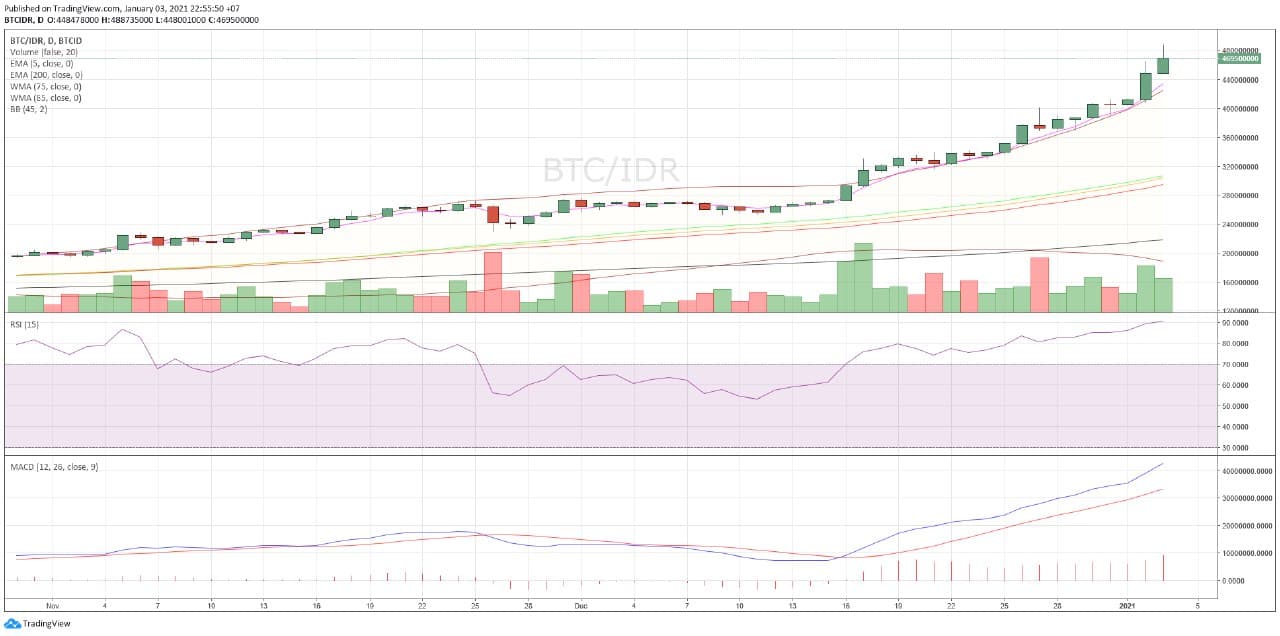

Chart Bitcoin/IDR

In today’s trading, BTC moved at the lowest level at IDR427,698,000 and the highest level at IDR488,735,000.

Here’s BTC’s technical analysis this week:

| action | ||

| EMA 5 | 433,597,215 | buy |

| WMA 75 | 303,888,676 | buy |

| WMA 85 | 294,733,573 | buy |

| EMA 200 | 219,048,675 | buy |

| RSI (15) | 90.8508 | overbought |

| MACD 12,26 | 42730214.24 | buy |

| Summary | BUY (5) Overbought (1) | |

| bullish |

- Ethereum (ETH)

Ethereum is also entering into a bullish crypto asset this week. Ethereum has also been holding out for the last few weeks. The increase in ETH prices occurred due to high demand.

ETH has started the evolution of Ethereum 2.0 phase 0 in December 2020 ago. The full evolution to Ethereum 2.0 will happen gradually this year.

This is an attraction for ETH. Many analysts predict that ETH will again break through its historical high past Rp.17,000,000.

Chart ETH/IDR

In today’s trading, ETH moved at the lowest level at IDR8,781,000 and the highest level at IDR9,196,000. ETH entered into 5 bullish crypto assets this week.

Here’s the ETH technical analysis for this week:

| action | ||

| EMA 5 | 11,196,403 | buy |

| WMA 75 | 8,529,413 | buy |

| WMA 85 | 8,314,973 | buy |

| EMA 200 | 6,337,080 | buy |

| RSI (15) | 80.1602 | overbought |

| MACD 12,26 | 826181.5687 | buy |

| Summary | BUY | |

| bullish |

- Dogecoin (DOGE)

Dogecoin (DOGE) experienced a significant increase in prices last week. The price jumped by about 150%. This happened after Tesla Inc CEO, Elon Musk stated that DOGE is his favorite crypto asset.

He stated this through his Twitter account. This makes DOGE demand quite increasing. So that the price has also increased fantastically.

The Doge dog meme emblem is quite a popular coin. Although this coin is a meme or a joke coin, the increase in price is not a “joke” you know.

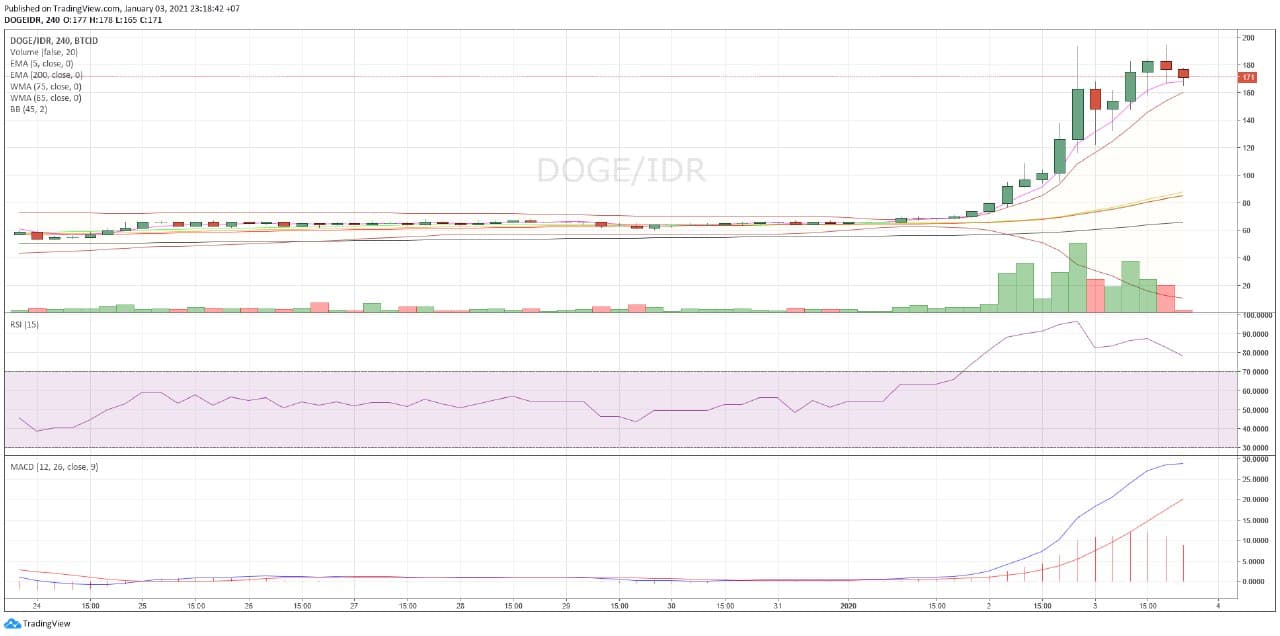

Chart DOGE/IDR

In today’s trading, DOGE moved at the lowest level of Rp120 and the highest level was Rp195. DOGE has entered into 5 bullish crypto assets this week.

Here’s the DOGE technical analysis for this week:

| action | ||

| EMA 5 | 168 | buy |

| WMA 75 | 87 | buy |

| WMA 85 | 84 | buy |

| EMA 200 | 65 | buy |

| RSI (15) | 78.4286 | overbought |

| MACD 12,26 | 28.8633 | buy |

| Summary | BUY (5) overbought (1) | |

| bullish |

- Litecoin (LTC)

The crypto asset that is experiencing a bullish or next increase in price is Litecoin (LTC). This crypto asset is a derivative of Bitcoin. When viewed, the charts are very similar to BTC.

LTC is one of the most popular altcoins or alternative coins. In fact, DOGE is also a derivative of LTC.

Chart LTC/IDR

In today’s trading, LTC moved at the lowest level of IDR1,808,000 and the highest level was IDR2,104,000. LTC entered into 5 bullish crypto assets this week.

Here’s LTC’s technical analysis for this week.

| action | ||

| EMA 5 | 1,939,161 | buy |

| WMA 75 | 1,354,837 | buy |

| WMA 85 | 1,307,977 | buy |

| EMA 200 | 1,008,175 | buy |

| RSI (15) | 74.8269 | buy |

| MACD 12,26 | 192488.2219 | buy |

| Summary | buy | |

| bullish |

- Bitcoin Cash (BCH)

The next bullish crypto asset is still an altcoin derived from bitcoin, namely Bitcoin Cash (BCH).

BCH is widely used by people as a remittance. Because the price is still much cheaper than BTC, it is easier for people to use BCH to make payments and exchange.

Chart BCH/IDR

In today’s trading, BCH moved at the lowest level of IDR 4,844,000 and the highest level of IDR 5,781,000. BCH has entered into 5 bullish crypto assets this week.

Here’s the BCH technical analysis for this week:

| action | ||

| EMA 5 | 5,165,741 | buy |

| WMA 75 | 4,254,038 | buy |

| WMA 85 | 4,206,411 | buy |

| EMA 200 | 3,992,762 | buy |

| RSI (15) | 68.4237 | buy |

| MACD 12,26 | 298462.9995 | buy |

| Summary | BUY | |

| bullish |

Here Are 5 Bearish Crypto Assets This Week

- Tether (USDT)

Tether (USDT) has continued to decline over the past few weeks. USDT is a type of stablecoin which is a US Dollar (USD) based crypto asset.

Because the US Dollar is still weakening due to the impact of the pandemic and polemic after the Presidential Election, this has contributed to the decline in USDT.

In fact, USDT functions more as a crypto asset for payment, not to be owned and stored as an investment. At Indodax, there is a USDT market that can exchange USDT crypto assets for others.

Meanwhile, USDT in the United States is also used as a means of payment. Because the value is 1: 1 in US Dollars (USD).

Chart USDT/IDR

In today’s trading, USDT moved at the lowest level of IDR13,800 and the highest level was IDR14,099.

Here’s the USDT technical analysis for this week:

| action | ||

| EMA 5 | 14,043 | sell |

| WMA 75 | 14,161 | sell |

| WMA 85 | 14,185 | sell |

| EMA 200 | 14,480 | sell |

| RSI (15) | 43.2534 | neutral |

| MACD 12,26 | -27.6858 | sell |

| Summary | SELL (5) NEUTRAL (1) | |

| bearish |

- Aurora (AOA)

Aurora (AOA) is a crypto asset based on decentralized finance (DeFi). AOA is a crypto asset that has experienced a decline in prices this week.

AOA has not been able to increase innovation this week and has not been able to increase.

Chart AOA/IDR

In mid-year trading, AOA moved at the lowest level of IDR 21 and the highest level of IDR 23.

Here’s the AOA technical analysis for this week:

| action | ||

| EMA 5 | 23 | sell |

| WMA 75 | 68 | sell |

| WMA 85 | 70 | sell |

| EMA 200 | 120 | sell |

| RSI (15) | 30.9093 | sell |

| MACD 12,26 | -11.4203 | sell |

| Summary | SELL | |

| bearish |

- Attila (ATT)

Attila (ATT) is a crypto asset that saw its price decline this week. ATT includes two protocol layers.

The first layer is used as the basic communication protocol to carry out basic connection functions; the second layer is used as an additional protocol to perform cross-product communication functions.

Naturally, this crypto asset is bearish due to its not-so-good rating. ATT is ranked 252th on rating website Coinmarketcap.com.

Chart ATT/IDR

In today’s trading, ATT moved at the lowest level of IDR 1,500 and the highest level of IDR 1723

Here’s the ATT technical analysis for this week:

| action | ||

| EMA 5 | 1,655 | sell |

| WMA 75 | 1,734 | sell |

| WMA 85 | 1,741 | sell |

| EMA 200 | 1,836 | sell |

| RSI (15) | 34.454 | buy |

| MACD 12,26 | -23.7139 | overbought |

| Summary | SELL (5) buy (1) oversold (1) | |

| bearish |

- DASH

DASH is an open source project that offers instant, easy and secure payments, at almost zero cost. DASH is known as the first Decentralized Autonomous Organization (DAO) and has pioneered innovative features such as masternodes, InstantSend, ChainLocks, and PrivateSend.

DASH innovation has not been able to increase demand, so DASH will experience a price decline.

Chart DASH/IDR

In today’s trading, the lowest price of DASH is at the level of Rp1,200,000 and the highest price is Rp1,288,000.

Here’s the DASH technical analysis for this week:

| action | ||

| EMA 5 | 1,251,342 | sell |

| WMA 75 | 1,391,469 | sell |

| WMA 85 | 1,398,723 | sell |

| EMA 200 | 1,392,631 | sell |

| RSI (15) | 42.0622 | buy |

| MACD 12,26 | -51476.1269 | oversold |

| Summary | SELL (4) buy (1) oversold (1) | |

| bearish |

- Ripple (XRP)

Ripple (XRP) is a crypto asset that is experiencing a decline. The downward trend will still occur for the next week. This is after XRP experienced a fantastic decline last week.

XRP was declared by the SEC, the Exchange and Securities Commission (SEC) of the United States of America who stated that XRP had committed fraud. As a result of this, XRP experienced a drastic drop in demand as all crypto asset brokers in the United States delisted.

Chart XRP/IDR

In today’s trading, XRP moved at the lowest level of IDR 3023 and the highest level of IDR 3315.

Here’s the XRP technical analysis for this week:

| action | ||

| EMA 5 | 3,247 | sell |

| WMA 75 | 5,915 | sell |

| WMA 85 | 5,803 | sell |

| EMA 200 | 4,631 | sell |

| RSI (15) | 34.1122 | sell |

| MACD 12,26 | -1099.1103 | sell |

| Summary | SELL | |

| bearish |

NOTE: If the EMA 5 crosses the WMA 75, 85 and 200 EMA and these lines intersect from bottom to top, the market trend tends to go up (bullish),

In each table above, it shows that if the value of EMA 5 is higher than WMA 75.85 and EMA 200 then the market tends to rise (bullish).

If the RSI and MACD values ??show the same condition, it means that the market is showing the same trend, overbought condition or oversold condition is an indicator that the market is at a point of changing the trend direction.

ATTENTION: All content which includes text, analysis, predictions, images in the form of graphics and charts, as well as news contained in this website, is only used as trading information only, and does not constitute a suggestion or suggestion to take an action in a transaction either buying or selling certain crypto assets. All crypto asset trading decisions are independent decisions by the user. Therefore, all risks arising from it, whether it is profit or loss, are not the responsibility of Indodax.