XRPHEDGE is top bullish crypto asset this week. This token is one of the FTX tokens. In other words, this innovation can give you leveraged exposure to the crypto market, without all the need to manage leveraged positions. You can buy leveraged tokens just like regular tokens on the spot market, however, you don’t need to manage collateral, margin, liquidation prices, or anything that normal margin users need to manage as long as prices are maintained by FTX.

Come on, find out more as a reference!

5 Bullish Crypto Assets

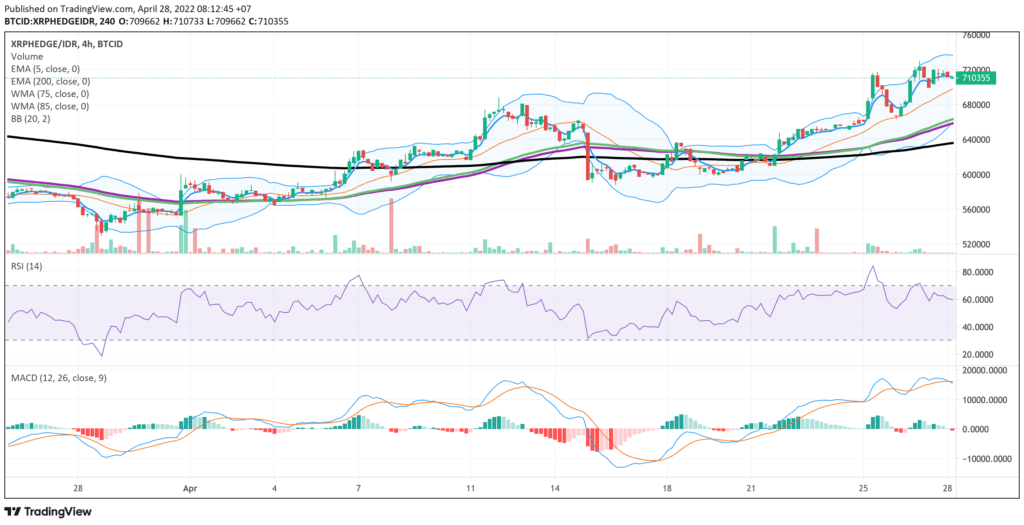

1X Short XRP Token (XRPHEDGE)

The rise of 1X Short XRP Token (XRPHEDGE) is inseparable from the decline that occurred in XRP. The increase has occurred since April 12, 2022, when this upturn occurred with the rise in purchases of this coin. It was about to enter the bearish phase on April 20, 2022 – April 22, 2022, because it seemed like it would break the support line of 596,690, but this was not the case, because 1X Short XRP Token (XRPHEDGE) reversed course instead and was able to break the resistance line at the price level of 639,500.

Since this token is a token of the FTX exchange, as usual, you have to find out the fundamental and technical analysis beforehand, yes! All crypto asset trading decisions are independent decisions by the user. Therefore, all risks arising from it, whether profit or loss, are not the responsibility of Indodax.

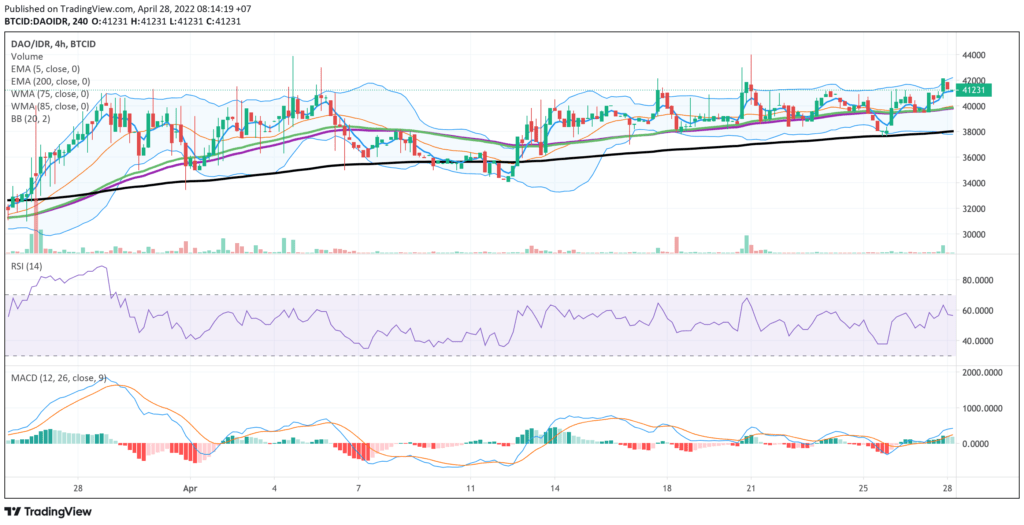

Knife Maker (DAO)

It had sideways, but turned into a bullish phase after being able to break the resistance line at the price range of 30,000 – 31,000, this breakout has occurred long enough since March 27, 2022. The candle would touch the 200 EMA line at the price level of 36.650, which makes this price level the closest support line.

MACD indicator shows that there is a positive trend in DAO/IDR which possibly make DAO/IDR continue strengthening.

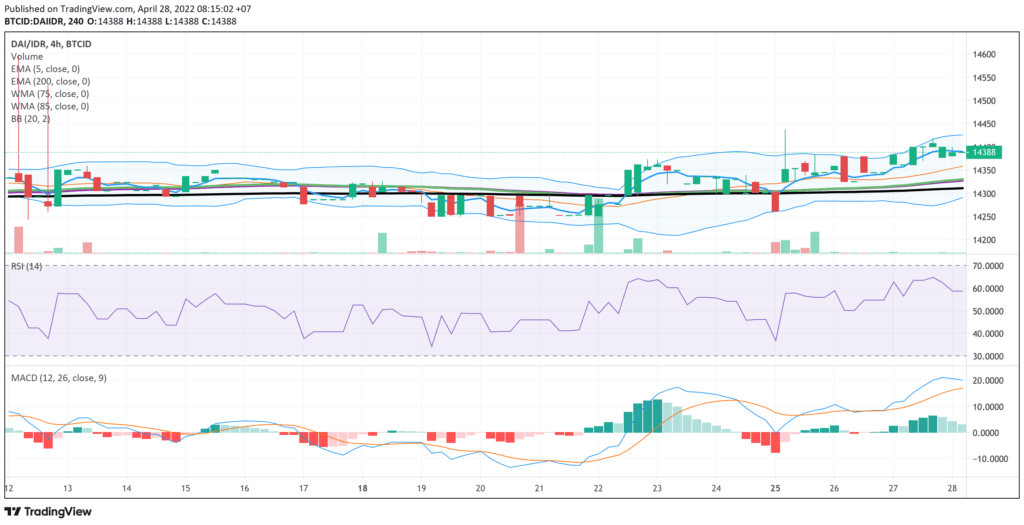

Multi-collateral DAI (DAI)

If using a 4-hour time frame, it can be seen that multi-collateral DAI’s (DAI) trend movement is mostly on sideways phases, but on April 22, 2022, it began to show the uptrend phase which was characterized by EMA 5 cutting through the EMA 200 followed by the upward convergence of WMA 75 and WMA 85.

With MACD indicator showing a positive trend, there is a possibility for Multi-collateral DAI (DAI) to experience a strengthening.

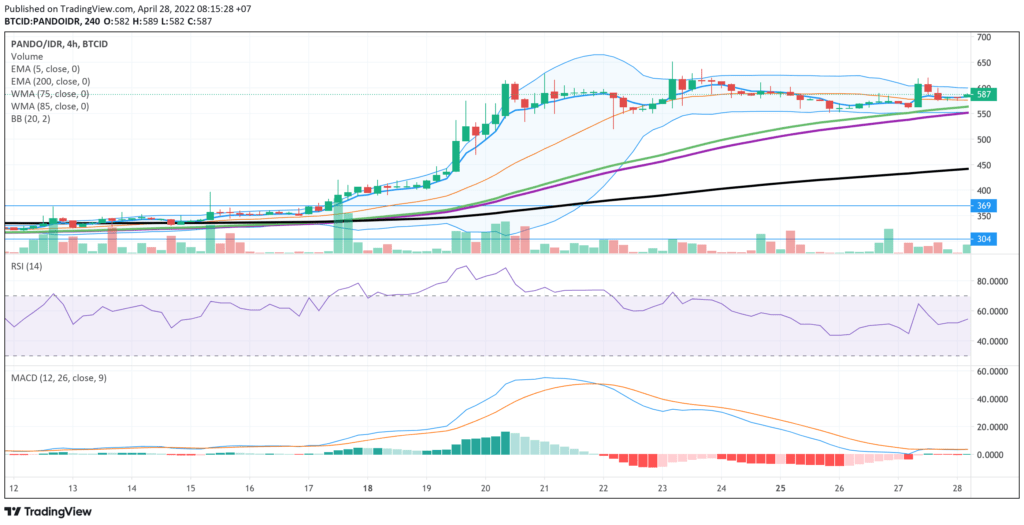

Pando (PANDO)

Before being in the bullish phase, PANDO/IDR was sideways with a price range of 370 – 300. This sideways phase took place from April 06, 2022, to April 17, 2022. Given the breakout from this sideways phase, it was able to make Pando (PANDO) touch the highest price level since January 15 with a price range of 650 – 651.

The increase that has occurred makes Pando (PANDO) currently in the sideways phase as indicated by MACD indicator, which shows it needs time to confirm the direction of the next trend.

0x (ZRX)

0x (ZRX) is an infrastructure protocol that allows users to easily trade ERC20 tokens and other assets on the Ethereum blockchain without relying on centralized intermediaries like the traditional cryptocurrency exchanges. In 2019, 0x announced an overhaul of ZRX tokens, adding extra utility, allowing ZRX holders to delegate their shares to market makers to earn passive rewards while maintaining their voting capacity.

It had touched the support at the price level of 10,700 – 10,650 and also touched the WMA 200 level, but ZRX/IDR reversed course instead and continued to strengthen in the bullish phase. If there is a slowdown, it will test the price range of 9,580 – 9,460 but if there is a strengthening it will test the resistance level in the price range of 13,620 – 13,860.

5 Bearish Crypto Assets

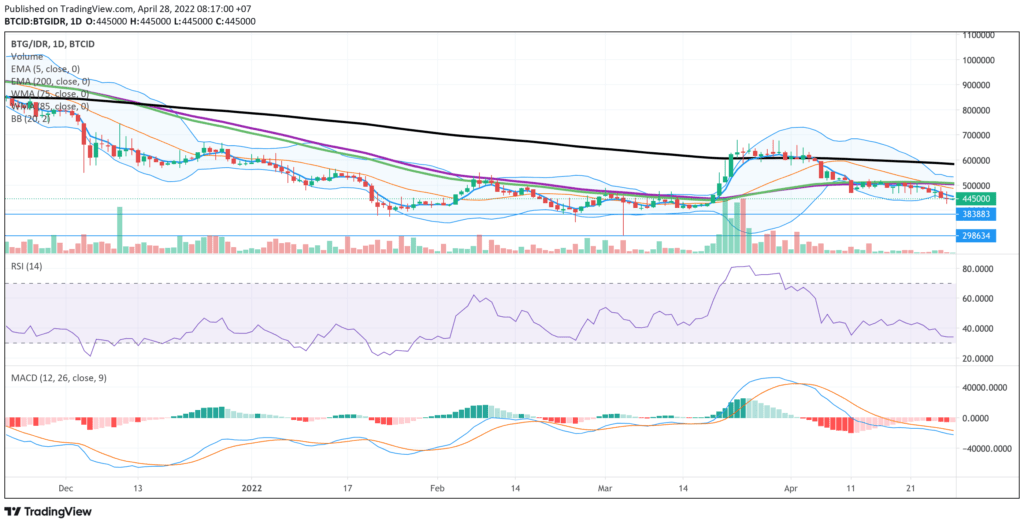

Bitcoin Gold (BTG)

This Bearish Phase of Bitcoin Gold (BTG) was confirmed by the cutting of EMA 5, WMA 75, and WMA 85 to below the EMA 200, which occurred from December 13, 2021, to December 15, 2021. When viewed from this period, it can be said that BTG/IDR has been experiencing price weakening for a while.

The weakening that is still ongoing will test the price level of 390,760. If this price level is broken then it will test the next support level at the price range of 380,000 – 298,600.

Klaytn (KLAY)

Klaytn was launched in June 2019. Klaytn is a public blockchain platform that provides an accessible user experience and development environment to convey the value of blockchain technology. The platform combines the best features of the public blockchain (decentralized data and control, distributed governance) and private blockchain (low latency, high scalability) through an efficient ‘hybrid’ design. Klaytn aims to bring blockchain technology to all types of users, from micro-startups to corporate divisions.

A fairly deep price weakening occurred in KLAY/IDR. This weakening started on April 07, 2022. The price decline made Klaytn (KLAY) touch its lowest price since August 26, 2021. Considering that the price has been corrected quite deep, KLAY/IDR has the potential to strengthen, the resistance level is in the price range of 14,400 – 16,550.

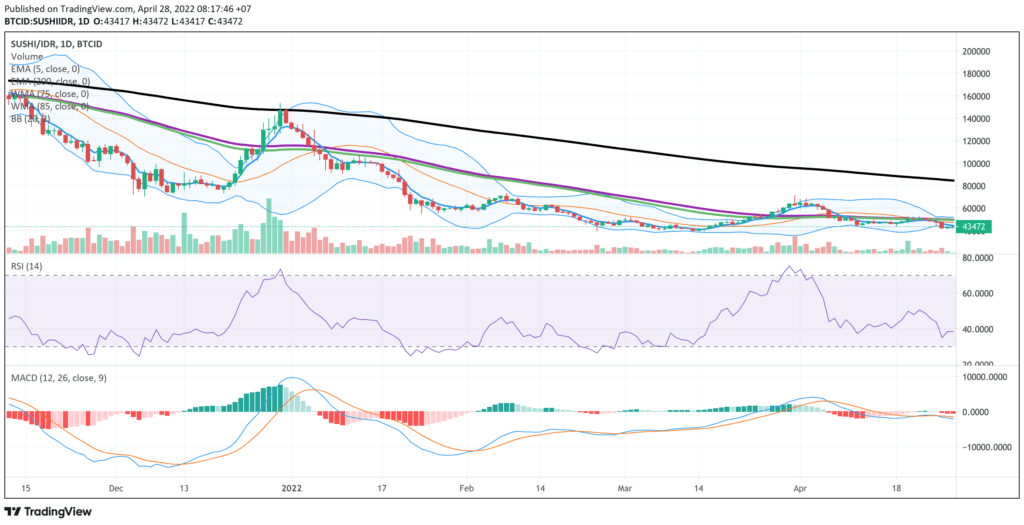

SushiSwap (SUSHI)

SushiSwap (SUSHI) has experienced a deep weakening to date because it is unable to hold on to the support of 134,000, which confirmed the bearish trend. It had experienced a strengthening on December 30, 2022, touching the price range of 154,000, and reversed to break the support level at the price of 71,650 afterward.

The MACD indicator shows that this narrowing is quite reasonable because SUSHI/IDR has experienced a deep correction.

Bitcoin SV (BSV)

The use of a 1-Day time frame on BSV/IDR can make you see a wider movement. It touched the highest price twice on April 15, 2021, at the price of 7,108,565, and on May 06, 2021, in the price range of 6,538,620 after touching those price levels Bitcoin SV (BSV) experienced a very significant correction, which indicates that the level of selling pressure is very high.

If it experiences a further correction, Bitcoin SV (BSV) will test the support level at 750,000, which is a support line formed in May 2019.

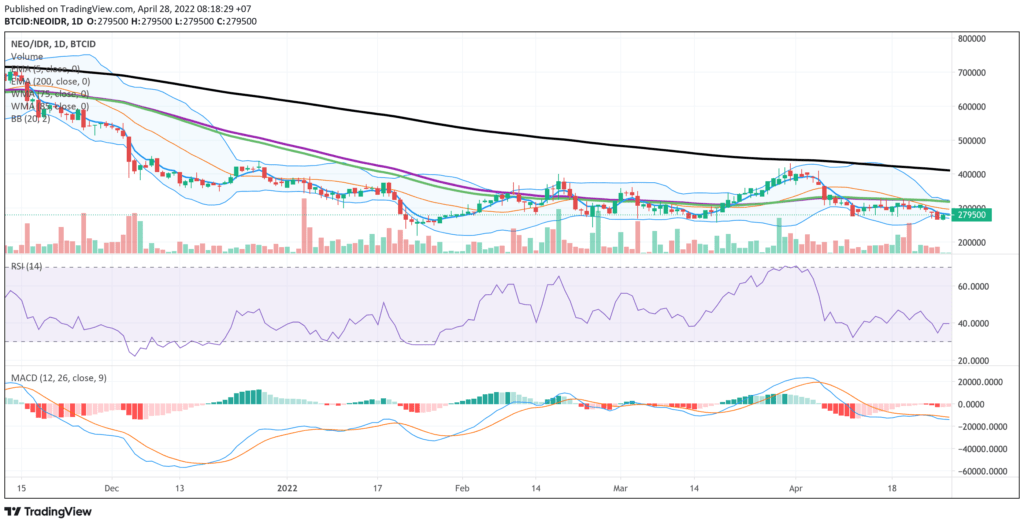

Neo (NEO)

When using the 1-Day time frame, the correction has occurred since NEO/IDR touched the All-Time High (ATH) at the price of 2,147,800 on April 11, 2021. After touching the ATH price, Neo (NEO) immediately fell and entered the bearish phase from July 09, 2021, to July 15, 2021.

This weakening is also in line with the MACD indicator which shows that there is a negative trend in Neo (NEO), which will be further confirmed by the RSI indicator.

NOTE: If the 5 EMA crosses the WMA 75, 85, and 200 EMA lines and the lines intersect from the bottom up, then the market trend tends to go up (bullish), each table above shows that if the 5 EMA value is higher than the 75.85 WMA and 200 EMA, the market tends to go up (bullish).

If the RSI and MACD values ??show the same condition, it means that the market is showing the same trend. Overbought or oversold conditions are an indicator that the market is already at the point of changing the direction of a trend.

ATTENTION: All content which includes text, analysis, predictions, images in the form of graphics and charts, as well as news published on this website, is only used as trading information, and is not a recommendation or suggestion to take action in transacting either buying or selling. certain crypto assets. All crypto asset trading decisions are independent decisions by the users. Therefore, all risks arising from it, both profit and loss, are not the responsibility of Indodax.