Indodax Market signal this time still shows 5 crypto assets that went up and 5 crypto assets that went down. What are these crypto-assets?

Last week, Bitcoin reached a support level. However, this week, Bitcoin’s bullish trend seems to have seen. Thus, Bitcoin is entered the bullish market this week, May 3, 2021-9 May 2021 on the Indodax market.

In addition, Ethereum, which touched its highest level, will also continue its rally in the previous weeks. So, ETH is also still in a bullish crypto trend this week.

Although the Uniswap DeFi token (UNI) is included in the 5 bullish crypto assets, this is not the case with other DeFi crypto assets. Sushi Swap (SUSHI) and Saffron Finance (SFI) are even among the 5 crypto assets that are down or bearish.

Moreover, crypto-assets that have experienced price increases? Then, what else is the crypto asset that has experienced a decline in price? Let’s discuss them in full below.

5 Bullish Crypto Assets This Week

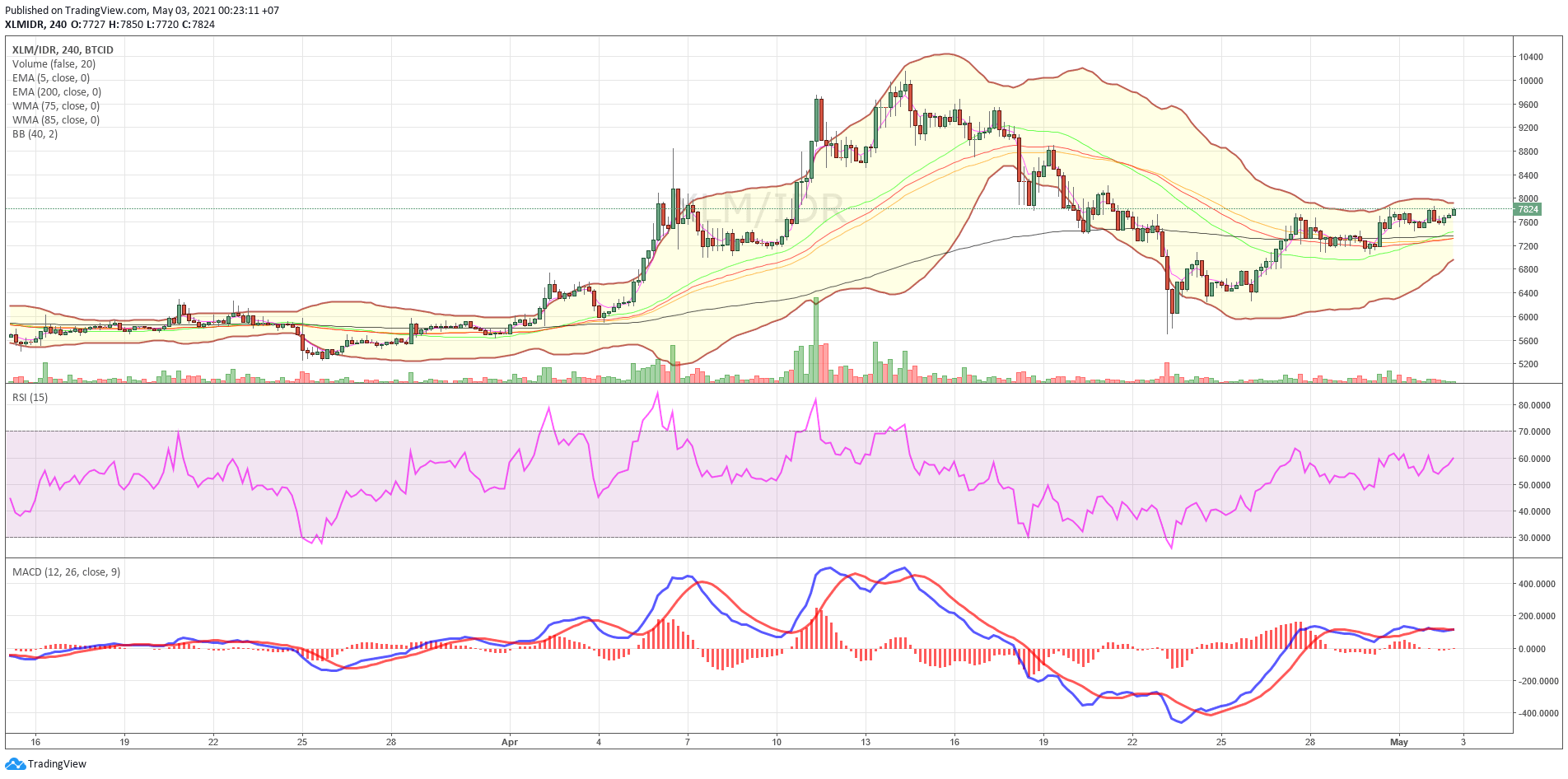

- Stellar Lumens (XLM)

Stellar Lumens (XLM) is the first crypto asset to increase this week. XLM is a cryptocurrency from The Stellar Development Foundation (SDF) is a non-profit organization based in San Francisco.

SDF is building a shared finance platform, designed to be open and accessible to everyone. Just as the internet allows anyone to send an email or create a blog, Stellar now allows people to send, store, and receive money easily, without major expense or hassle.

Today, XLM’s lowest price is IDR 7,545 and the highest is IDR 7,877.

Chart XLM/IDR

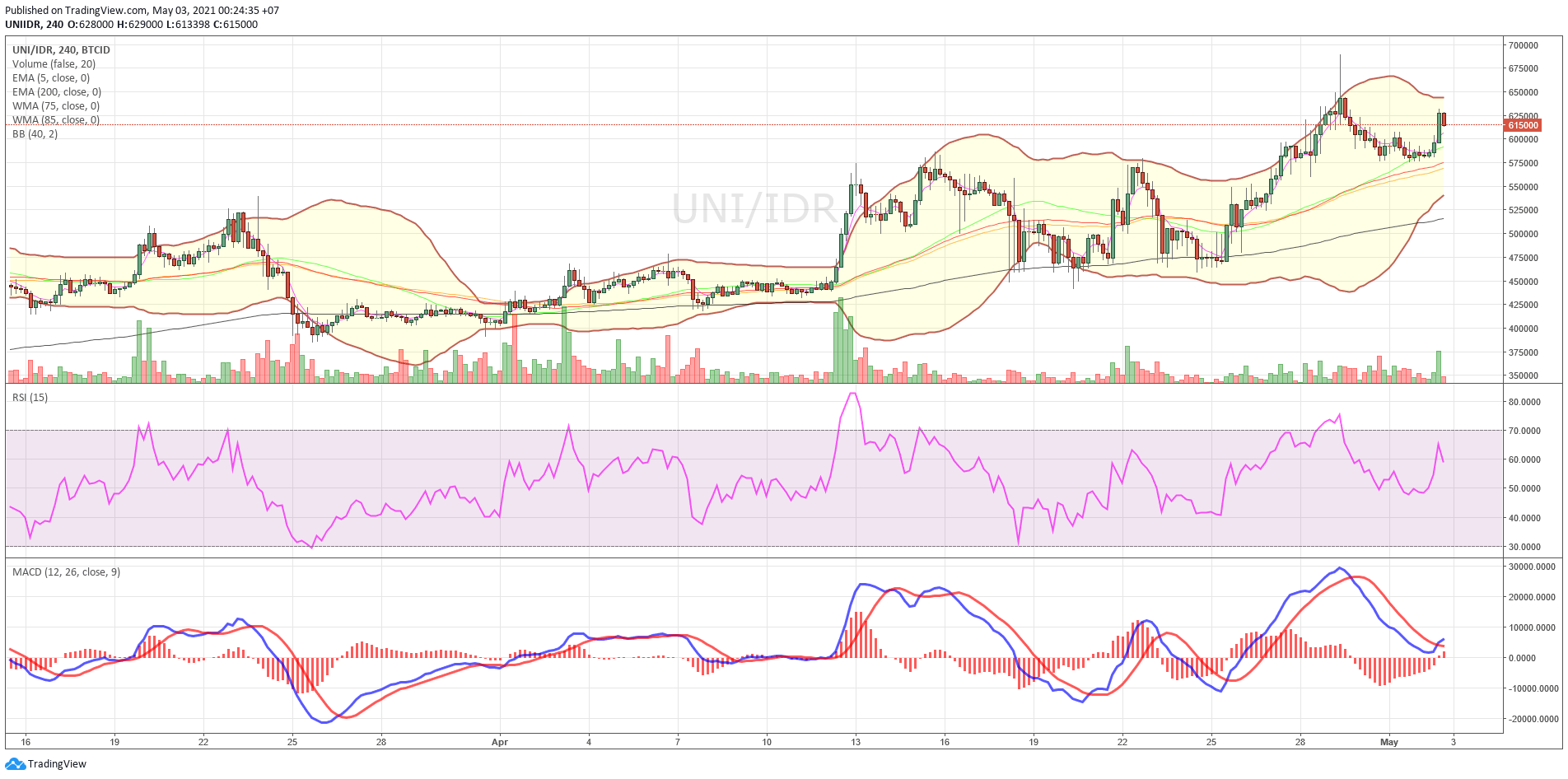

Second, the next rising crypto asset is Uniswap (UNI). The increase occurred because there was a V3 mainnet upgrade, as listed on coinmarketcal.com.

UNI is one of the most popular DeFi crypto assets used by people. The UNI support trend has also been seen at the end of the week and today, after correction during the downtrend last week.

In today’s trade, UNI’s lowest price is IDR464,646 and the highest is IDR550,000.

Chart UNI/IDR

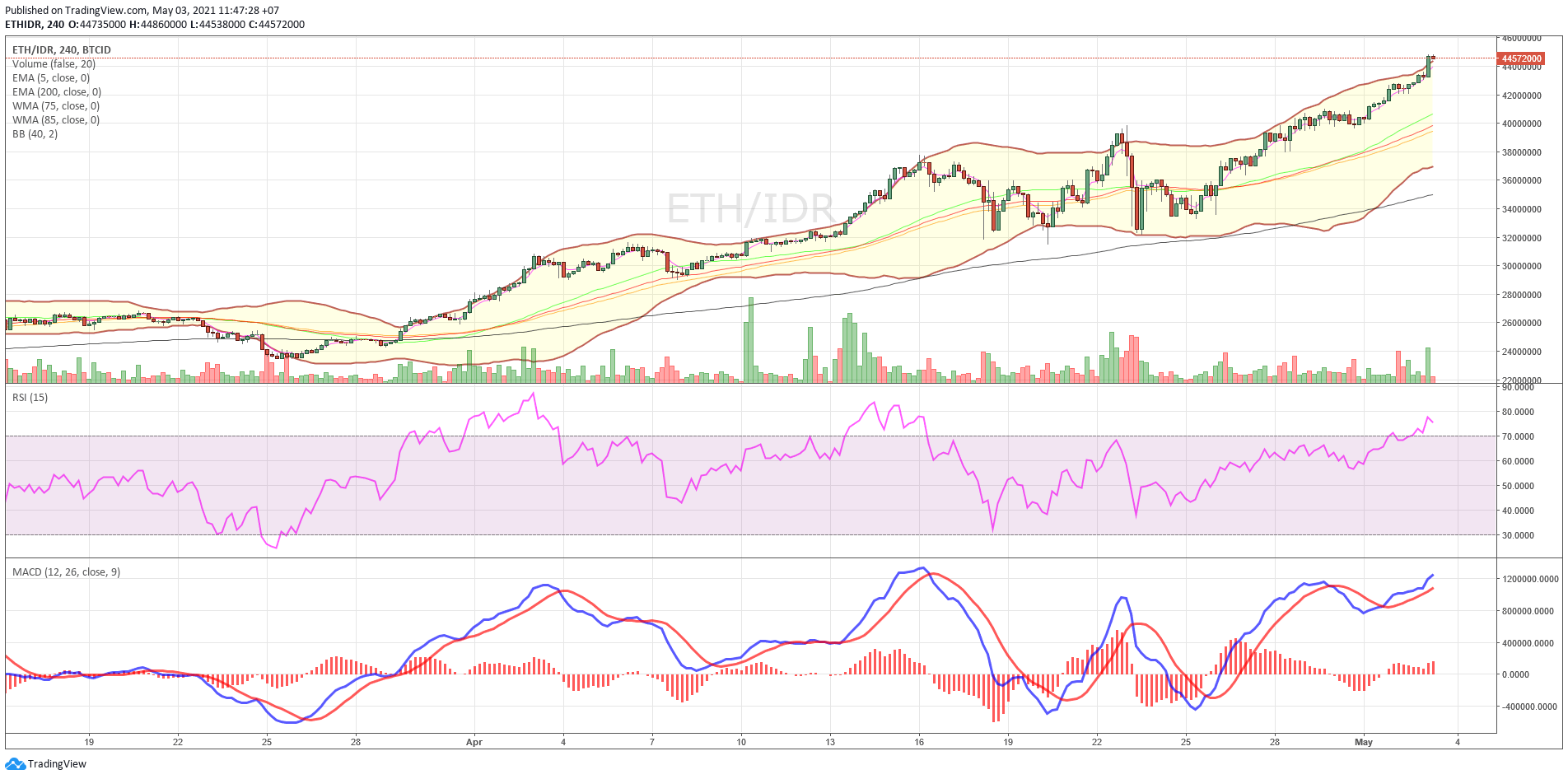

Next, the crypto asset that went up was Ethereum (ETH). Ethereum’s rising price trend continues. Although, sometimes Ethereum experiences price corrections.

During the downtrend yesterday, Ethereum was still at its highest level, around IDR 33 million – IDR 35 million. ETH will still show an increase in price as the crypto is currently being upgraded to Ethereum 2.0.

In the middle of the year, this crypto will upgrade EIP-1159 or burn some ETH. This is to reduce its maximum supply in the future. Because this crypto is improving to overcome its shortcomings, which is an unlimited supply.

The lowest price for ETH today is IDR 42,100,000 and the highest is IDR 44,800,000

Chart ETH/IDR

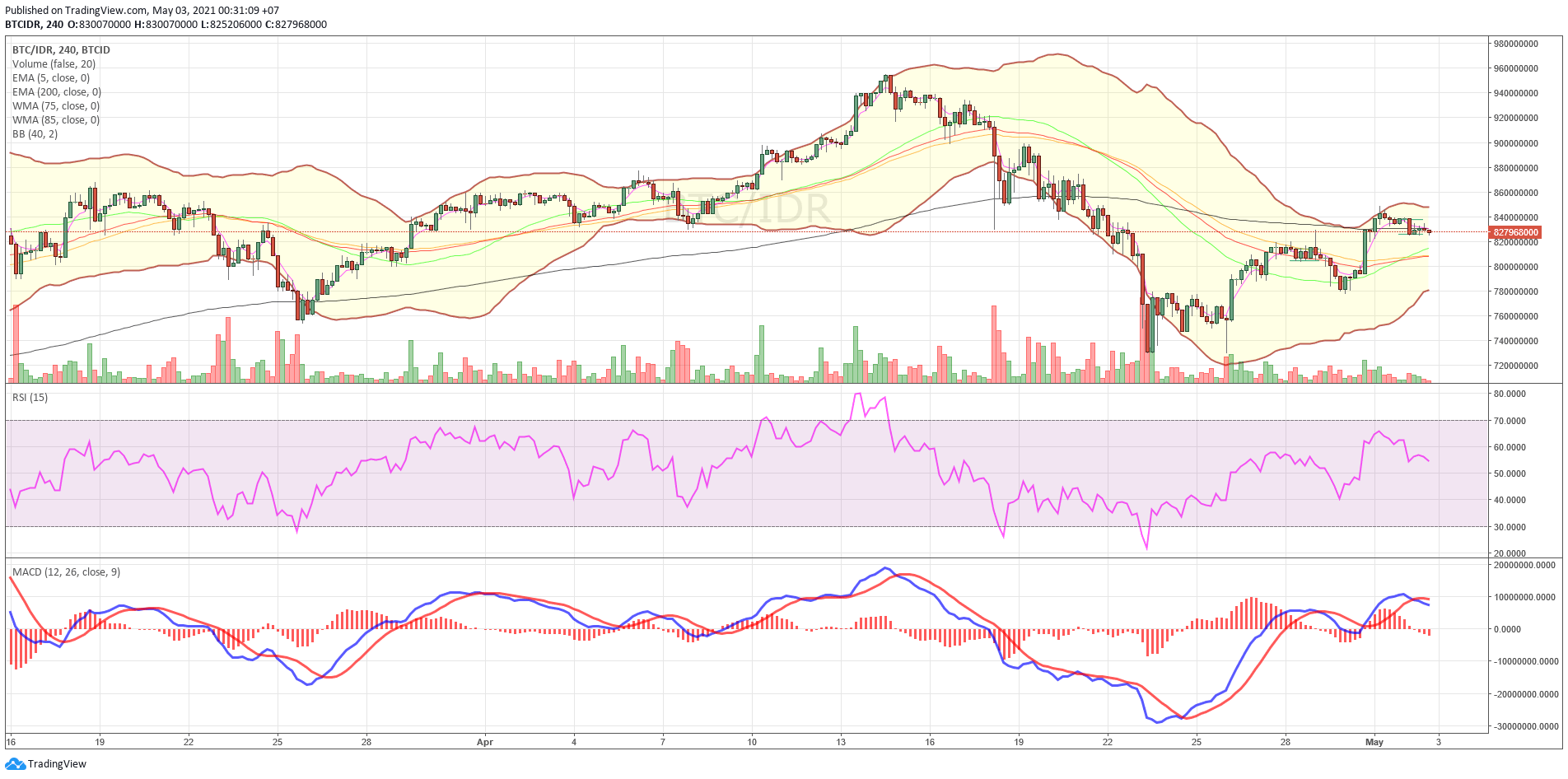

Next, the crypto asset that went up during the week was Bitcoin. Last week, Bitcoin touched the support level at the level of Rp. 720 million. After that, he climbed to the highest level past Rp. 800 million.

Bitcoin seems to have passed its saturation period. It seems that the driving factor was the news rumors that Alibaba bought USD 20 billion worth of Bitcoin or around Rp. 288 trillion. However, it is still only a rumor.

Bitcoin has also been predicted to reach its highest level this year. Bitcoin could have reached IDR 1 billion or even up to IDR 2 billion.

As of today, the Ethereum price is at the lowest level of IDR 825,000,000 and the highest price is IDR 839,636,000

Chart BTC/IDR

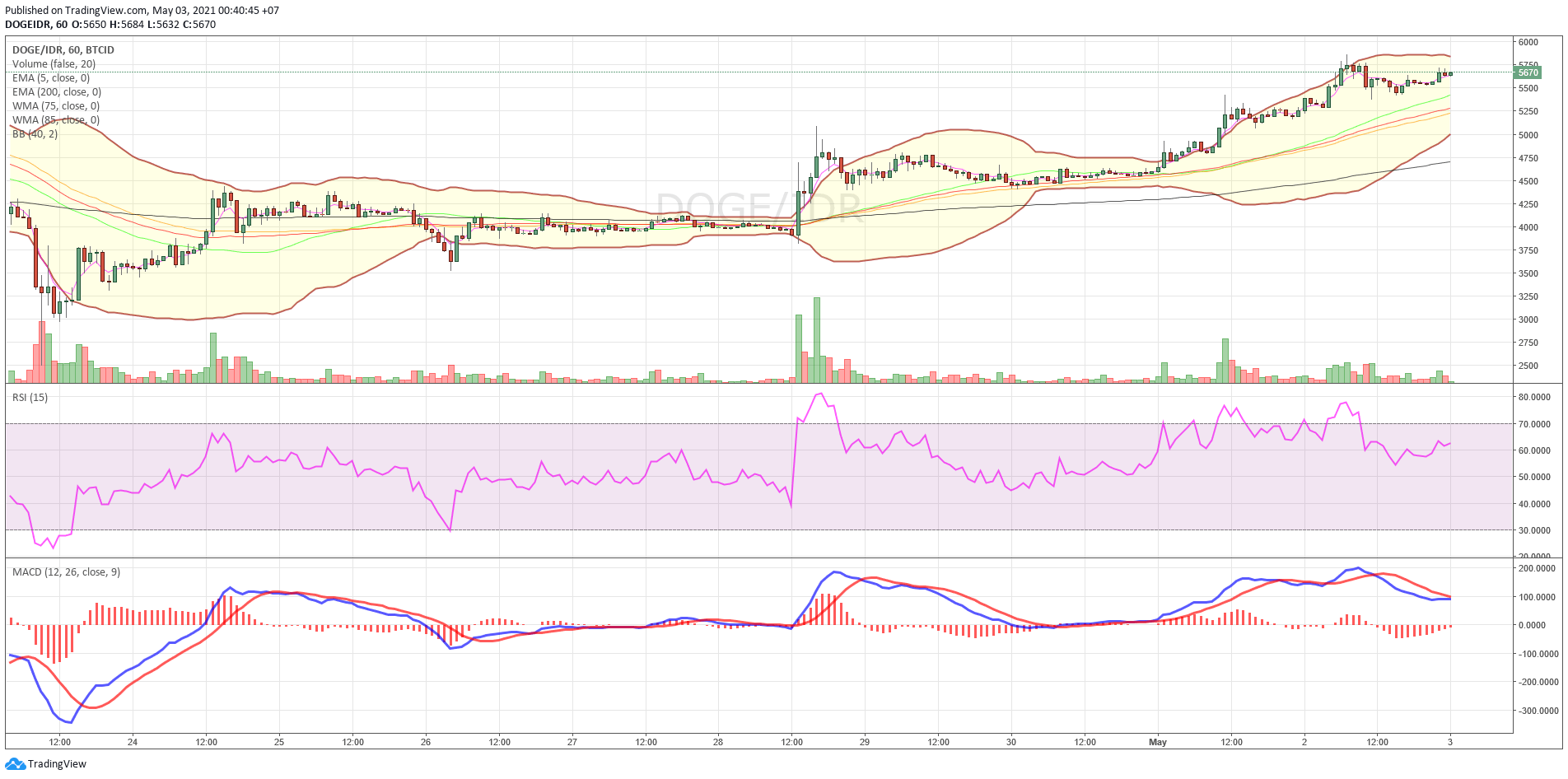

Lastly, Dogecoin (DOGE). This crypto is predicted to increase in price. This crypto is a crypto that has often increased dramatically after Elon Musk’s tweet. The increase in DOGE this week has been seen from last weekend. DOGE has increased. Although it is not certain the cause of this crypto rise.

DOGE is moving today with the lowest price of IDR 5,445,000 and the highest price of IDR 6,200,000

Chart DOGE/IDR

Here Are 5 Bearish Crypto Assets This Week

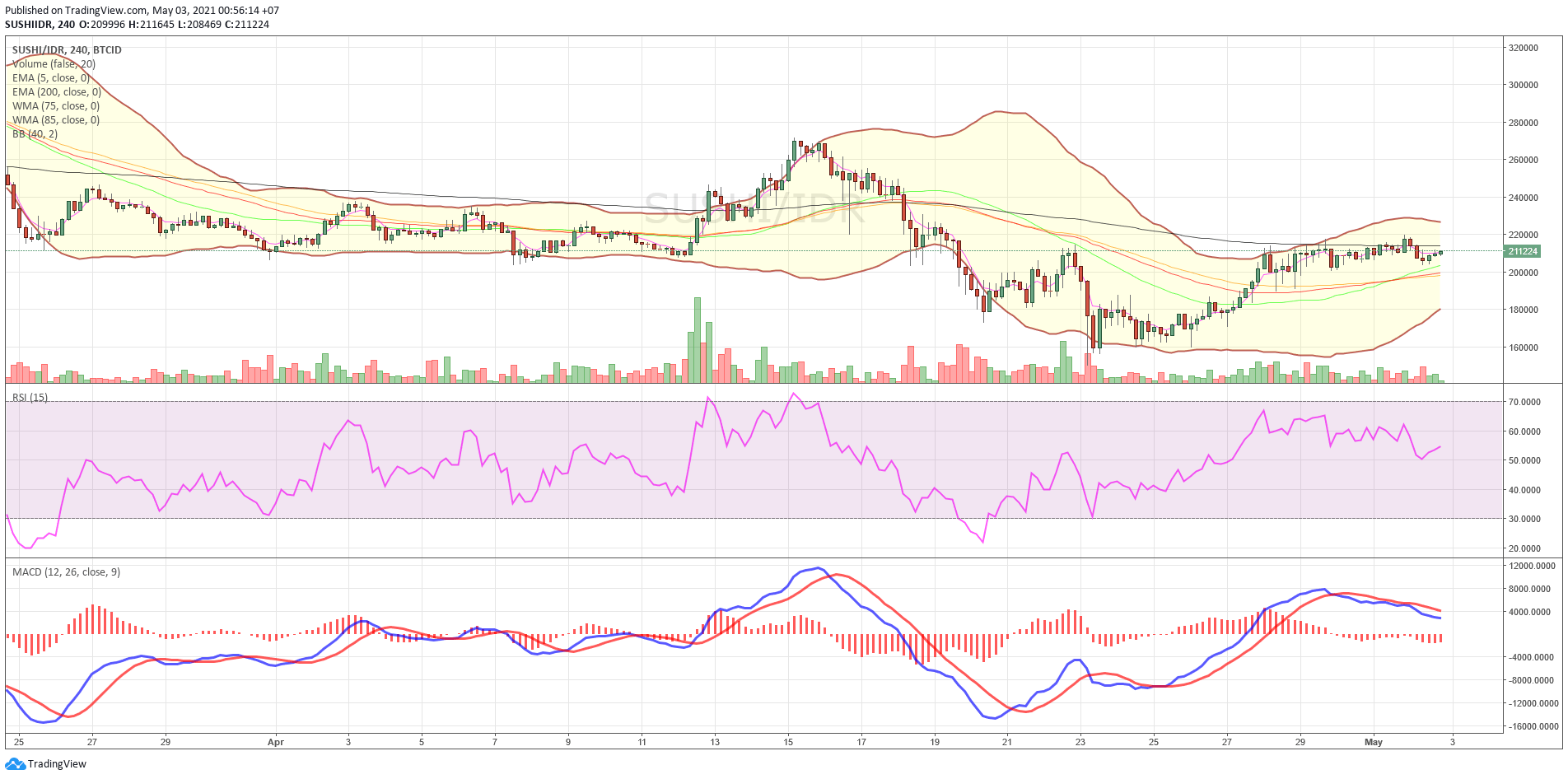

- SushiSwap (SUSHI)

Although Uniswap, DeFi crypto assets have increased, but not with SushiSwap (SUSHI). This crypto even entered the 5 crypto assets that were bearish this week. It could be that stakers switch to the Uniswap platform because they will upgrade the mainnet V3.

Although, SushiSwap is actually an evolution from Uniswap with $ SUSHI tokenomics. The protocol better aligns incentives for network participants by introducing revenue sharing & network effects to the popular AMM model.

As of today, SUSHI is moving with the lowest price of IDR 204,000 and the highest price of IDR 219,999.

Chart SUSHI/IDR

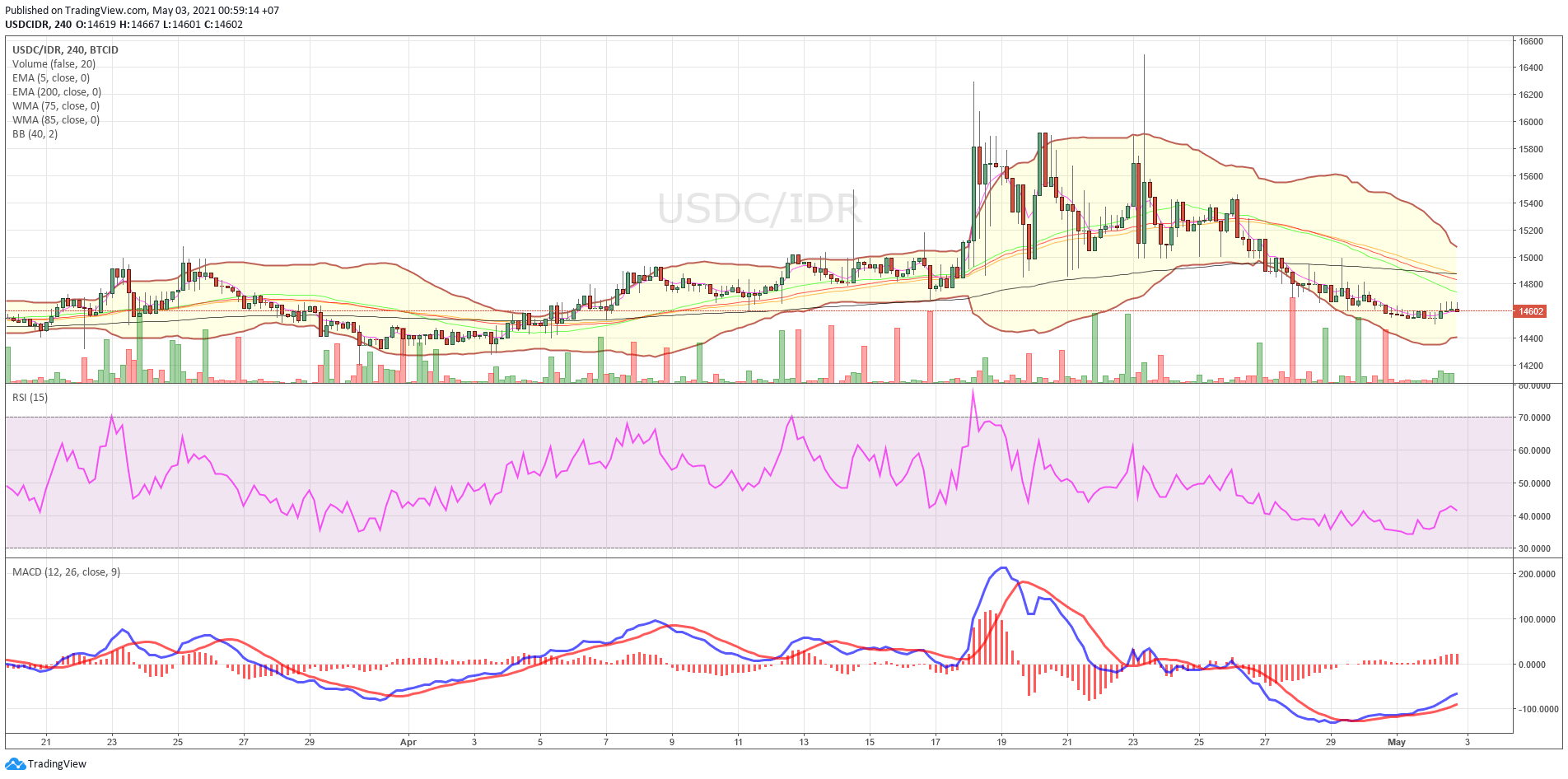

- USD Coin (USDC)

USDC’s stablecoin crypto assets are likely to experience a downturn this week. This is due to the weakening of the dollar currency. However, this decline is considered not to last long.

USDC crypto assets are crypto stablecoins from US Dollar in the United States which is proportional to 1: 1. USDC is usually used by the United States platform Coinbase.

USDC’s lowest price is IDR14,506 today. Meanwhile, the highest price is IDR 14,677.

Chart USDC/IDR

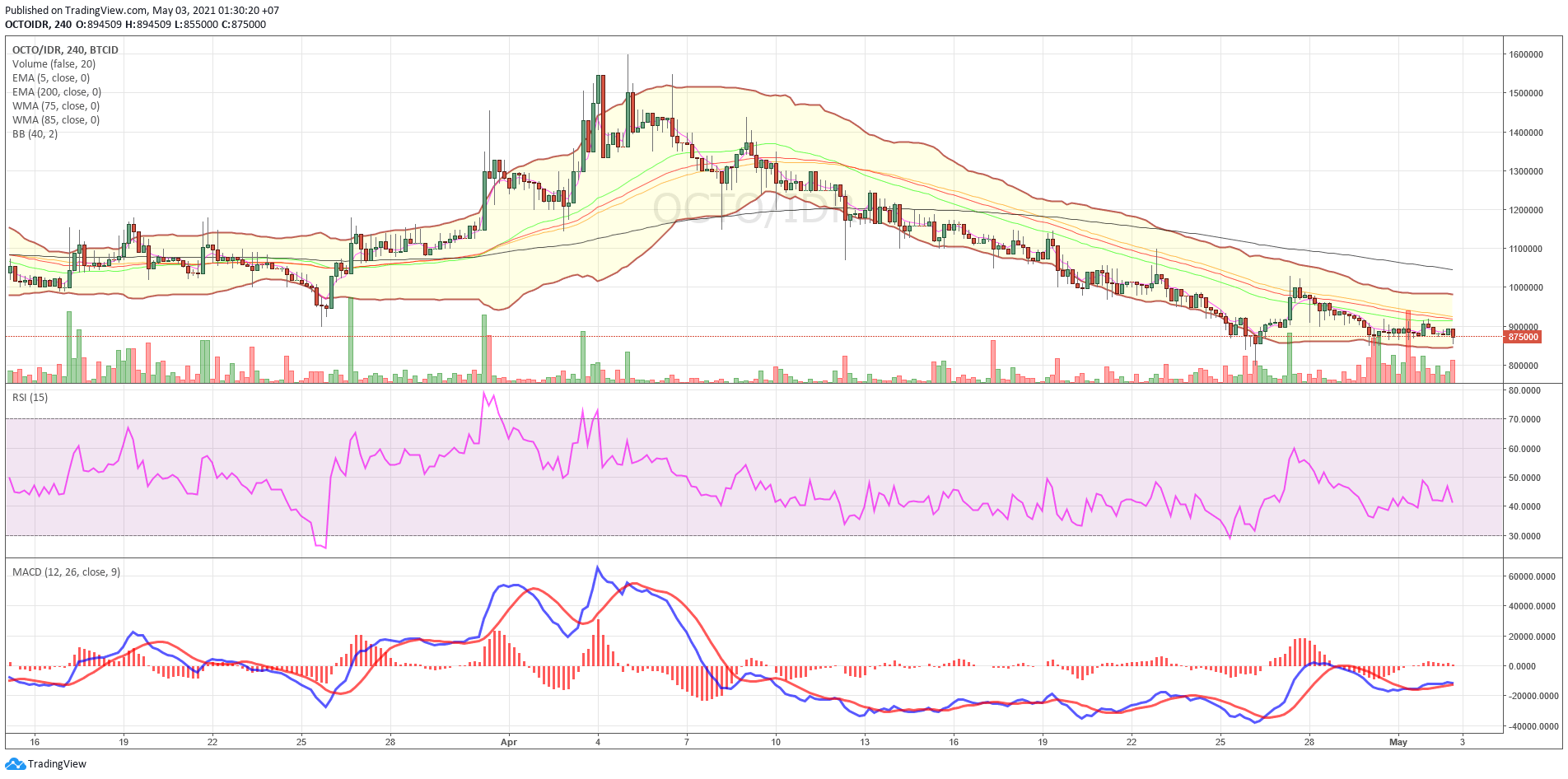

- OctoFi (OCTO)

Third, there is OctoFi (OCTO) which has experienced a decline in prices. This crypto asset is not very popular and is a DeFi crypto asset. This crypto asset didn’t have a very good rating, so it was abandoned by its fans.

Today, OCTO is moving at the lowest level of IDR 855,000 and the highest price of IDR 919,998.

Chart OCTO/IDR

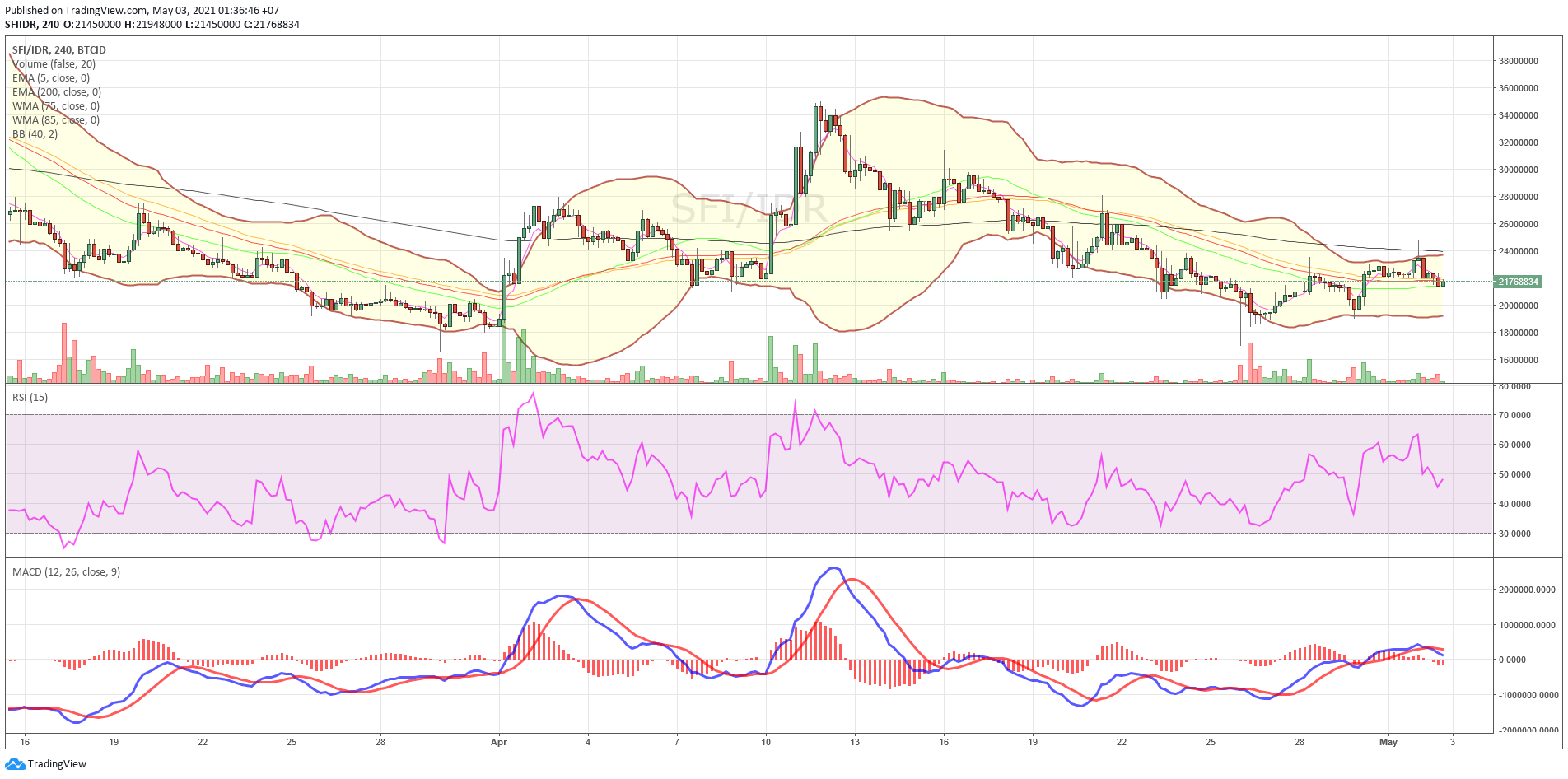

- Saffron Finance (SFI)

Next, still from DeFi crypto assets, namely Saffron Finance (SFI). This crypto is likely to experience a price decline this week. SFI also seems unable to increase this week because the stakers might switch to Uniswap.

SFI sold for IDR 21,478,571, the lowest in today’s trading. Meanwhile, the highest price reached IDR 24,777,777.

Chart SFI/IDR

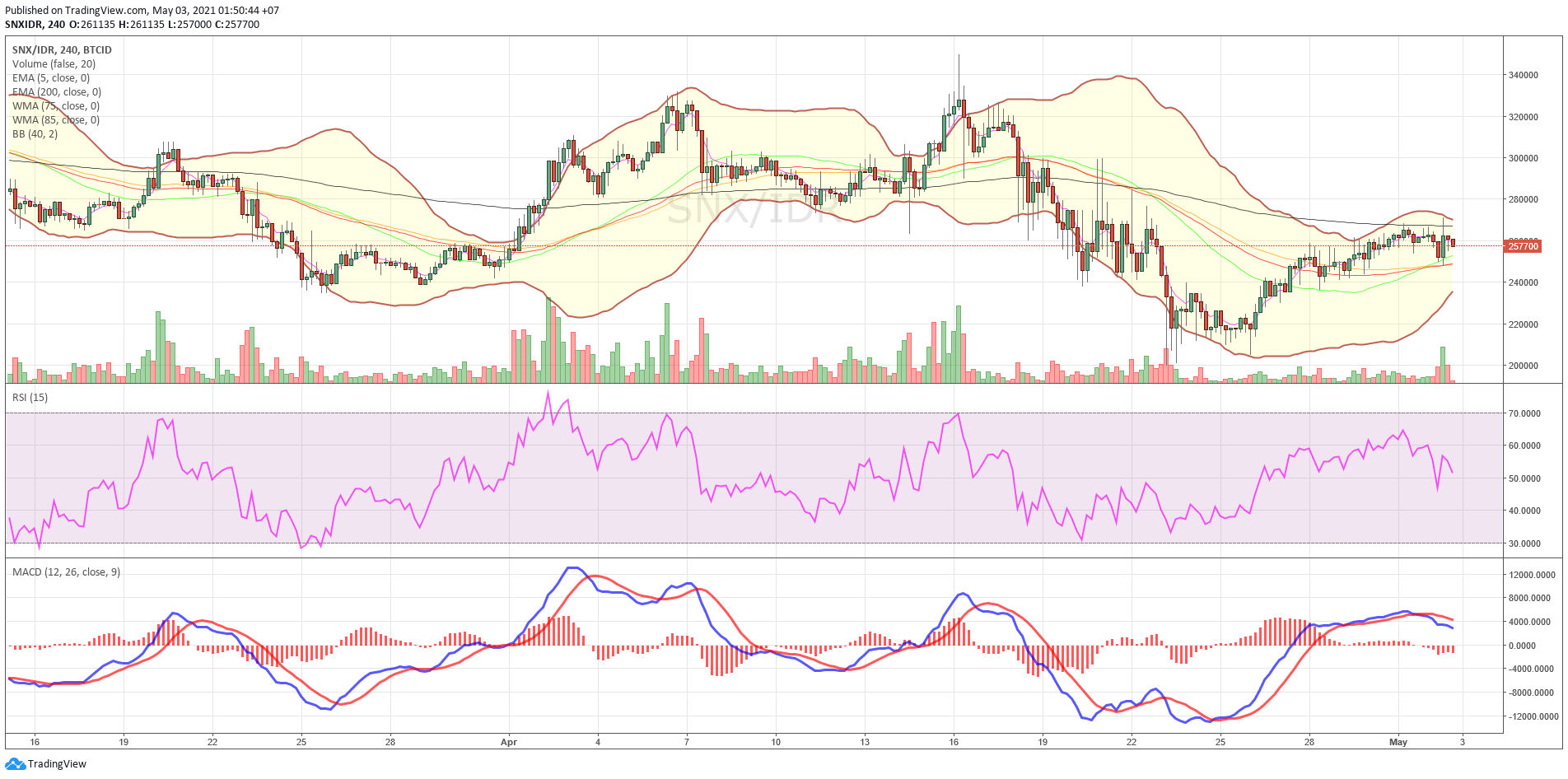

- Synthetix Network Token (SNX)

Finally, SNX is likely to experience a decline this week. SNX went down as this crypto asset seemed to be abandoned by its investors. Because there is still no new technology development from SNX.

In today’s trading, SNX’s lowest price is IDR 248,010 and the highest is IDR 271,397.

Chart SNX/IDR

NOTE: If EMA 5 crosses the WMA 75, 85 and EMA 200 lines and these lines intersect from bottom to top, the market trend tends to go up (bullish),

In each table above, it shows that if the value of EMA 5 is higher than WMA 75.85 and EMA 200 then the market tends to rise (bullish).

If the RSI and MACD values ??show the same condition, it means that the market is showing the same trend, overbought conditions or oversold conditions are an indicator that the market is at a point of changing the direction of the trend.

ATTENTION: All content which includes text, analysis, predictions, images in the form of graphics and charts, as well as news contained on this website, is only used as trading information only, and does not constitute a suggestion or suggestion to take an action in a transaction whether to buy or sell certain crypto assets. All crypto asset trading decisions are independent decisions by the user. Therefore, all risks arising from it, both profit and loss, are not the responsibility of Indodax.