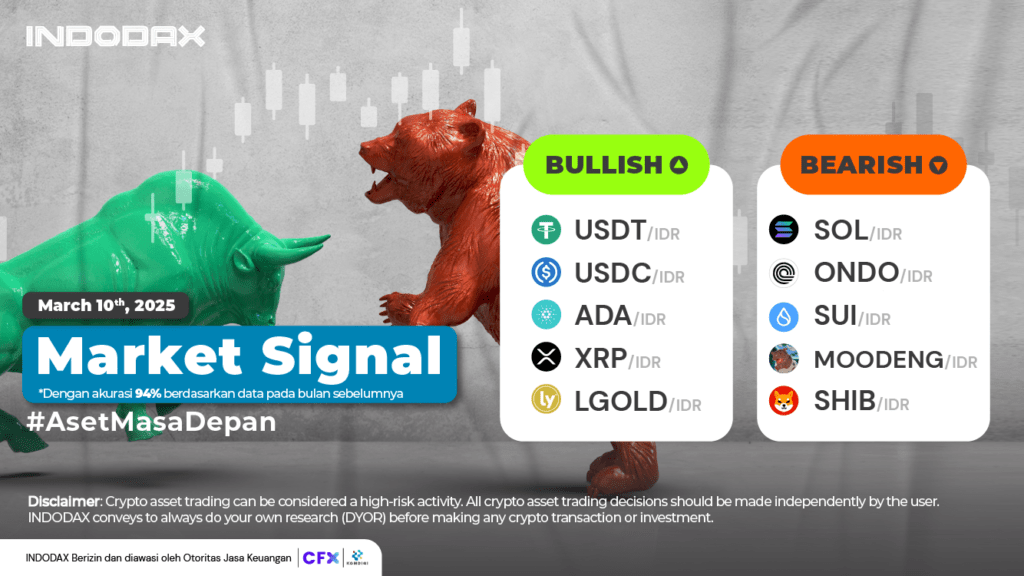

This week, the bullish crypto lineup is led by USDT(USDT) in first place, followed by USDC(USDC) and CARDANO(ADA).

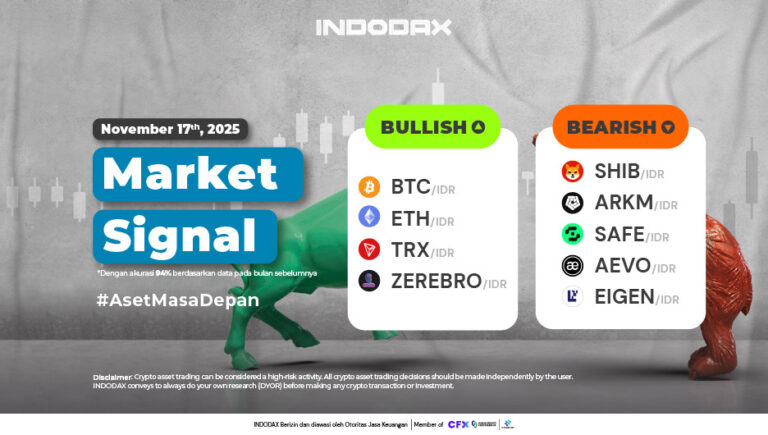

Want to know how your favorite crypto asset is performing? Check INDODAX Market Signal below!

5 Bullish Crypto Assets

1.USDT (USDT)

USDT Volume indicator (USDT) shows a stable movement, with the level of selling and buying quite dominant so that the volume of USDT (USDT) is quite large. The Bullish trend can still be continued with the current trend remaining above WMA / 85, Support is available in the area of ??16,000 – 16,250.

2.USDC (USDC)

The USDC (USDC) price trend on the 1-Day chart is moving fluctuatively, the Bollinger Bands indicator as one of the indicators used indicates that USDC (USDC) has the opportunity to move more fluctuatively by breaking through one of the areas of 16,600 – 17,000.

3.Cardano (ADA)

The positive price increase in the Uptrend phase is unlikely to continue with Cardano (ADA) moving below the EMA/200 followed by a downward intersection of the WMA/85, if realized the MACD indicator will show negative movement.

4.XRP (XRP)

Negative pressure in the Bullish phase will be stronger with the movement of the XRP (XRP) price below the 28,000 – 35,000 area, making XRP (XRP) test the EMA / 200 Support. The next support is available in the price range of 20,000 – 25,000.

5.Lyfe Gold (LGOLD)

The price managed to strengthen, inseparable from Lyfe Gold (LGOLD) which still managed to stay above the WMA/85, the MACD indicator shows a negative trend but is not directly proportional to the price of Lyfe Gold (LGOLD) which still shows positive movement.

The price managed to strengthen, inseparable from Lyfe Gold (LGOLD) which still managed to stay above the WMA/85, the MACD indicator shows a negative trend but is not directly proportional to the price of Lyfe Gold (LGOLD) which still shows positive movement.

5 Bearish Crypto Assets

1.Solana (SOL)

??Solana (SOL) experienced a fairly positive price strengthening spike, however the trend was unable to confirm the direction of Solana (SOL)’s movement with the Candle being held back and not having managed to pass the EMA/200 causing Solana (SOL) to give a negative reaction so that Solana (SOL) weakened again in accordance with the Bearish trend.

2.Ondo (ONDO)

The weakening of the Ondo (ONDO) trend is in accordance with what was predicted by the MACD indicator, with Ondo (ONDO) failing to penetrate the EMA/200 or the dominant Resistance level of 19,000 – 22,000.

3.Sui (SUI)

The Bearish Sui (SUI) phase will be able to reverse direction towards a positive trend by breaking through several Resistance areas, namely 44,000 – 55,000 with the next 60,000 – 70,000 the reversal direction is realized the MACD indicator will move positively.

4.Moo Deng (MOODENG)

The opportunity to improve the price weakening is quite wide open, Moo Deng (MOODENG) is currently estimated to be in the Oversold area on the RSI indicator with the impact of the Moo Deng (MOODENG) price weakening of more than 75%.

5.Shiba Inu (SHIB)

The weakening trend is reflected in the 4-hour time frame, Shiba Inu (SHIB) failed to move up above WMA/85, negatively impacting the price of Shiba Inu (SHIB) which experienced a weakening. Shiba Inu (SHIB) is currently indicated by the RSI indicator to be in the Oversold area, a fairly deep weakening is one of the causes.

If you look at the EFI trend movement on the 1 Day chart, after being able to break from the level of 1,110 – 1,270 EFI moved stronger past WMA / 85. The Bearish Trend will be broken if the Candle is able to stay above the Resistance zone in the range of 2,370 – 2,850.

NOTE: If the 5 EMA crosses the WMA 75, 85 and 200 EMA lines and the lines intersect from the bottom up, then the market trend tends to go up (bullish), each table above shows that if the 5 EMA value is higher than the 75.85 WMA and 200 EMA, the market tends to go up (bullish).

If the RSI and MACD values ??show the same condition, it means that the market is showing the same trend. Overbought or oversold conditions are an indicator that the market is already at the point of changing direction of a trend.

ATTENTION: All contents which includes text, analysis, predictions, images in the form of graphics and charts, as well as news published on this website, is only used as trading information, and is not a recommendation or suggestion to take action in transacting either buying or selling. certain crypto assets. All crypto asset trading decisions are independent decisions by the users. Therefore, all risks arising from it, both profit and loss, are not the responsibility of Indodax.

Polkadot 8.79%

Polkadot 8.79%

BNB 0.53%

BNB 0.53%

Solana 4.77%

Solana 4.77%

Ethereum 2.37%

Ethereum 2.37%

Cardano 1.75%

Cardano 1.75%

Polygon Ecosystem Token 2.10%

Polygon Ecosystem Token 2.10%

Tron 2.85%

Tron 2.85%

Market

Market