Hello Indodax members, the last day of January 2022, here! Even though the price of crypto assets has dropped a lot this month, don’t forget to make this moment an opportunity to “Buy The Dip” yes! Precisely with the bearish market signal info, you can buy when the price is down. Read here for more details.

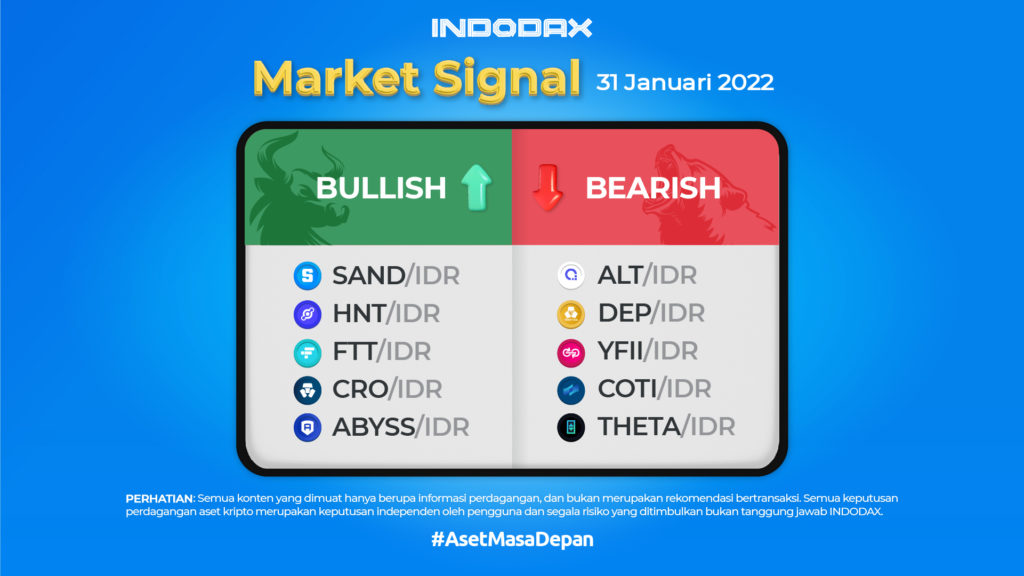

5 Bullish Crypto Assets

-

The Sandbox (SAND)

The first asset we will cover is the Sandbox. As one of the pioneers of the Metaverse game, Sandbox did experience a price increase in the midst of a red market. Just imagine, the Sandbox (SAND) refused to be bearish despite the broader negative market sentiment in the last 24 hours. Instead, SAND recorded a breakaway recovery as traders viewed the partnership profile that the Sandbox had recently brought home to be a sign that the project has strong fundamentals.

SAND was up 10.23% to $3.38 at the close of UTC on Jan. 27, followed by another 5.42% jump to $3.57 on Friday.

SAND’s exposure increased after Sandbox announced a partnership with American rapper Snoop Dogg and Warner Music, a major record label. On January 27, Snoop Dogg tweeted a teaser of what appears to be an upcoming non-fungible token collection (NFT), dubbed the “Snoop Avatar.” The rapper further hinted that his avatar would come as part of the Sandbox metaverse.

Somethin big comin soon. ?? Keep up 2 date @TheSnoopAvatars ? ? @TheSandboxGame https://t.co/GkqdAJE10L

— Snoop Dogg (@SnoopDogg) January 26, 2022

Later that day, Sandbox announced that it would create a music theme park and concert venue within its metaverse with the help of Warner Music. By doing so, the game project notes that Warner Music artists will virtually engage with their fans and generate revenue.

Although it had decreased until last January 22 at a price of 41 thousand, now the SAND/IDR pair was able to rise higher to 54 thousand. The next resistance is at the EMA/200 level at 61.255.

-

Helium (HNT)

Helium (HNT) fell to 385K on January 21, and continued to reach 300K on Jan 24, but the bears were unable to sustain lower levels. Bulls aggressively bought losses to these levels and pushed the price back above its January 26/25 MA up to 365K.

The price recovery was halted to the 400k level, and now the HNT/IDR pair is moving in the upperbands on the 4-hour chart at 380k – 400k price. This sideways movement does not seem to continue for long, if the candle is able to penetrate 400 thousand. The price has the potential to rise again to the EMA/200 line (436527)

This positive view will be invalidated if the price drops and falls below 350K. And it is possible that the bears will try to dominate the sales, so the price will return to its old support at the level of 300 thousand.

-

FTX Token (FTT)

FTT is the native token of one of the leading exchanges namely FTX.

FTX Token (FTT) experienced a strengthening in mid-January yesterday in terms of price movements, continuing to rise from 530 thousand on January 10 to 712 thousand on January 20. This spectacular asset did not go unnoticed by Crypto Twitter, as the volume of conversation increased. on January 14 and peaked the following day with 313 tweets. FTT’s solid performance continued even after tweet volume peaked. In this case, a spike in social attention can definitely alert traders to a profit opportunity.

After January 20, the price was corrected to the level of 467 thousand on January 24, but the bulls were still able to hold on and make purchases, and the price increased. Back to the time this article was written. The price is moving at the level of 579 thousand.

-

Crypto.com Chain (CRO)

Crypto.com Coin (CRO) is the native cryptocurrency token of the Crypto.com Chain — a decentralized open-source blockchain developed by payments, trading, and financial services company Crypto.com. CRO blockchain is primarily focused on providing utility to users of Crypto.com payment, trading and financial services solutions.

-

ABYSS

Abyss.Finance provides DeFi and CeFi solutions for projects across a wide range of industries. Abyss (ABYSS) is the native ERC20 token of the Abyss.Finance ecosystem. Within the Abyss.Finance ecosystem, Abyss is currently used on the Gaming platform (theabyss.com), Non-Fungible Token (NFT) market, and allows its members to earn rewards through Staking and Masternodes setup.

5 Bearish Crypto Assets

-

Alitas (ALT)

If last week ALT was bullish, this time the market has decreased slightly. If we take a peek at Alitas’ Twitter account, there aren’t many updates from the developer side. They do however still do some kind of publication and marketing for outreach. Do you think it’s enough to jack up the ALT price again? Maybe you want to use this opportunity to Buy The Dip?

-

DEAPCoin (DEP)

Just like ALT, last week DEP was in the ranks of bullish crypto assets. DEAPcoin has a unique and powerful team member. The Co-Founder is Yoshida Naohito, who has led 3 IPOs in Japan, and is a well-known figure in entertainment media companies. Co-CEO, Shigeru Shiina was previously President/CEO of PwC Japan and prior to PwC he was Vice President of KPMG Consulting Japan. The CFO was also previously the CFO of PWC Japan. Also Co-Founder and CSO Kozo Yamada has a lot of experience in producing music and variety programs at TV Tokyo Corporation, Yamada then founded an entertainment content production company called Tsukuriba, Inc., in 2018.

The Co-founders met and started a project to change the current anime and manga industry, to protect royalties and copyrights for manga and anime artists for the secondary market. By leveraging blockchain technology, creators can earn royalties forever as long as NFT trades are made. The project now employs more than r0 staff, including marketers from Hakuhodo, Netflix, Yahoo Japan, and financial institutions such as Mizuho.

-

DFI.Money (YFII)

DFI.MONEY, also known as YFII, is an offshoot of the popular decentralized financial aggregator (DeFi) platform, yearn.finance (YFI).

Launched in July 2020, it aims to optimize returns for DeFi investors while keeping up with proposed changes in the upgrade plan called YIP-8.

DFI.MONEY comes from the hard fork of yearn.finance, the aggregator for DeFi returns created by Andre Cronje. In July 2020, yearn.finance’s mining and farming of YFI tokens ended, and the proposal to protect the liquidity supply from whales gained 80% support among protocol participants. However, it was not adopted because it did not meet the 33% yearn.finance quorum requirement. As a result, a group of users chose to hard fork the protocol to create DFI.MONEY, with its own token, YFII.

-

COTI

COTI is the first enterprise-grade fintech platform that empowers organizations to build their own payment solutions and digitize any currency to save time and money.

COTI is one of the world’s first blockchain protocols optimized for decentralized payments and designed for use by merchants, governments, payment DApps, and stablecoin issuers.

Even though the movement of COTI is still in the bearish area, there is bullish momentum that can be used because there will be a COTI “treasury lunch” event on February 1, if the market responds positively. The COTI/IDR pair has the potential to rise and break the EMA/200 line at the price of 5100 and the next target to the levels of 6000 to 7000. Contrary to the scenario, if the bulls are not able to take this opportunity, COTI can correct again to the levels of 4100 – 3700.

-

THETA

THETA’s price is indeed down more than 73% from its all time high, but there are still a number of reasons why traders might consider keeping an eye on the project and you can take advantage of this to Buy The Dip.

Even if it could reverse fortunes, Theta still has some basic reasons for shareholders to be bullish in the long term.

Three reasons to stay bullish on THETA in 2022 include the upcoming launch of NFT ThetaDrop, the addition of new staking resources, and an overall focus on live streaming and gaming currently backed by major brand partnerships and integrations.

Currently THETA/IDR is still in the downtrend area, the decline continues to support the price of 37000. But in the near future on February 1 tomorrow, Theta will have a TDROP launch event “Theta is introducing a new TNT-20 token, TDROP, natively built on Theta blockchain that rewards NFT liquidity mining… February 1, 2022.” This momentum can be used to confirm, the possibility that the price will increase. Support moves between 37 thousand – 40 thousand, if the bulls are able to push the price, an increase can occur to the MA/25 level at the price of 51 thousand, and then to the price of 60 thousand and 78 thousand.

Don’t forget to read the Indodax Academy articles every day for complete details on Buy The Dip or buy when the price is down.

NOTE: If the 5 EMA crosses the WMA 75, 85 and 200 EMA lines and the lines intersect from the bottom up, then the market trend tends to go up (bullish),

each table above shows that if the 5 EMA value is higher than the 75.85 WMA and 200 EMA, the market tends to go up (bullish). If the RSI and MACD values ??show the same condition, it means that the market is showing the same trend, overbought (overbought) or oversold (oversold) conditions are an indicator that the market is already at the point of changing the direction of the trend.

ATTENTION: All contents which include text, analysis, predictions, images in the form of graphics and charts, as well as news published on this website, is only used as trading information, and are not a recommendation or suggestion to take action in transacting either buying or selling. certain crypto assets. All crypto asset-trading decisions are independent decisions by the users. Therefore, all risks stemming from it, both profit and loss, are not the responsibility of Indodax.