Imagine a cryptocurrency price that was initially stable suddenly plummeting in minutes. This isn’t always due to bad news, but rather due to market psychology triggering mass fear.

When one person sells, others follow suit, and the price crash only gets sharper. How can the price fall so quickly just because so many traders are panic selling?

What is a Long Squeeze?

A long squeeze is a market condition where the price of an asset falls significantly, causing pressure on traders who previously held long positions to sell their assets.

Their goal is simple: to avoid greater losses. However, because so many long traders panic-sell simultaneously, the price is pushed down even further.

This phenomenon demonstrates the powerful influence of market psychology on price movements.

The Difference Between a Long Squeeze and a Short Squeeze

Although less common than its opposite, a short squeeze, a long squeeze can have equally dramatic effects.

The difference lies in the direction of the pressure. A long squeeze puts pressure on long traders until the price plummets, while a short squeeze puts pressure on short traders until the price skyrockets.

In a short squeeze, short traders have a legal obligation to close their contracts by purchasing the promised asset, so the buying pressure can be very strong.

In a long squeeze, however, long traders have no actual obligation to sell, but the fear of losing more forces them to dispose of their assets amidst the price decline.

How Does a Long Squeeze Occur?

A long squeeze doesn’t just appear out of nowhere; it forms through a series of interrelated events.

From the initial price drop, pressure from leverage, to the domino effect of mass selling, all contribute to a downward spiral that becomes increasingly difficult to stop. The following is the mechanism:

Initial Trigger for the Decline

A long squeeze is usually initiated by external factors that push the price down. This could be negative news, the release of bad economic data, or a massive sell-off by a whale that immediately puts pressure on the market.

The Effects of Leverage and Margin Calls

The impact is even more severe when traders use leverage. With borrowed capital, even a small downward price movement can trigger a margin call. Traders are forced to close their positions by selling assets, which automatically increases selling pressure.

The Domino Effect of Mass Selling

The subsequent price drop triggers stop-loss orders and chain liquidations from other traders. This mass selling creates a downward spiral, causing the price to fall even further.

This is the essence of a long squeeze: a sharp downward movement that is not only caused by fundamental factors, but also by psychological effects and market mechanisms.

Long Squeeze Case Studies in the Crypto Market

The long squeeze is not just a theory, but a real phenomenon that recurs in the crypto market. In both Bitcoin and altcoins, this event often triggers massive liquidations and extreme price movements. Here’s an example:

Bitcoin: Billions of USD Liquidations

The Bitcoin market has recorded several long squeezes with liquidations reaching billions of dollars. Data from Coinglass frequently shows moments when the BTC price drops sharply, causing thousands of long positions to be liquidated in a short period of time.

For example, when BTC experiences a major correction, highly leveraged traders are significantly wiped out, intensifying the price pressure and plunging further.

Altcoins: More Extreme Movements

While long squeezes are quite brutal in Bitcoin, the impact can be far more extreme in altcoins. Highly volatile altcoins tend to be hit by long squeezes more quickly due to thinner order books and more erratic price movements.

Once a sharp decline occurs, highly leveraged long positions in altcoins can be liquidated en masse, creating an even faster downward spiral than Bitcoin.

The Impact of a Long Squeeze on Traders & Investors

A long squeeze is often considered a nightmare for traders. However, it can also be a golden opportunity for some investors.

This phenomenon demonstrates how fragile the market is when caught in mass panic, and how each market participant is affected differently. Here are some of the impacts:

1. Prices fall faster than predicted

When a long squeeze occurs, prices not only fall according to the natural trend, but can also plummet in a short period of time.

The domino effect of panic selling and liquidations makes the price drop feel much more extreme than normal, so technical or fundamental analysis often fails to anticipate it.

2. Long traders can suffer significant losses in an instant

Traders who open long positions, especially those with high leverage, are the most vulnerable. As soon as the price drops even slightly, margin calls and stop-loss orders can be triggered in a chain reaction.

In a matter of minutes, a position that initially seemed safe can turn into a major loss, even to the point of liquidation of all capital.

3. Long-term investors get a cheap buying opportunity

Behind the chaos, long-term investors sometimes take advantage of this moment. When the market panics and prices drop beyond normal levels, they see it as an opportunity to accumulate assets at low levels.

With a long-term perspective, a long squeeze can be a strategic entry point before prices recover.

How to Deal with & Anticipate a Long Squeeze

Long squeezes are difficult to predict, but that doesn’t mean traders and investors can’t develop strategies to deal with them. Here are some ways to deal with and anticipate a long squeeze, including:

Use Leverage Wisely

Avoid excessive leverage. The higher the leverage, the less room for price movement before a position is liquidated. With reasonable leverage, the risk of a margin call can be minimized.

Utilize Stop Loss & Take Profit

Disciplined use of stop loss and take profit is key to risk management. Stop losses help limit losses when the market moves against a position, while take profit secures profits before the trend reverses.

Read Sentiment & Liquidation Data

Traders can monitor market sentiment through on-chain analysis, open interest, and liquidation data from platforms like Coinglass. This information helps identify potential long squeeze areas before the price actually plummets.

Strategies for Spot Investors

Unlike traders who focus on short-term movements, spot investors typically have a long-term mindset.

Rather than panicking when prices fall, they can view a long squeeze as an opportunity to accumulate assets at lower levels.

Conclusion:

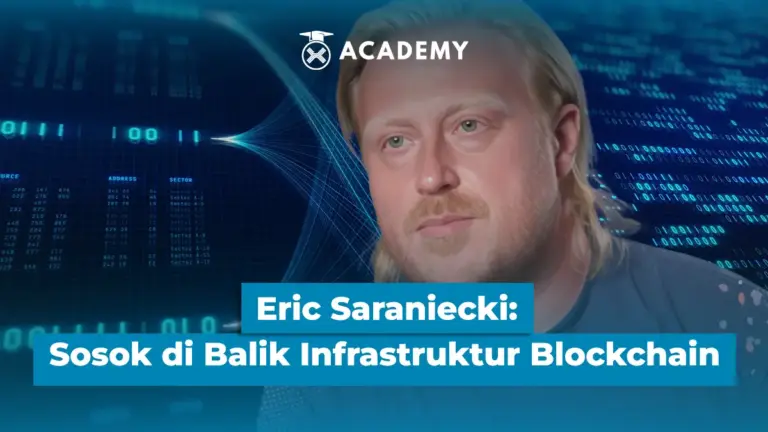

So, that was an interesting discussion about How a Long Squeeze Can Destroy Your Portfolio, and How Come?, which you can read in full at the INDODAX Academy.

In conclusion, a long squeeze is indeed frightening, but it’s a natural part of market dynamics. Every trader and investor will inevitably encounter a phase where prices fall faster than expected.

However, with proper risk management, this situation doesn’t always end badly. In fact, it can open up opportunities to enter at a more attractive price.

Ultimately, dealing with a long squeeze isn’t about avoiding it entirely, but rather about developing a strategy to stay calm and act wisely when panic strikes.

In addition to broadening your investment horizons, you can also stay updated with the latest crypto news and monitor digital asset price movements directly on the INDODAX Market.

For a more personalized trading experience, explore our OTC trading service at INDODAX. Don’t forget to activate notifications to stay up-to-date with the latest information about digital assets, blockchain technology, and various other trading opportunities, only on INDODAX Academy.

You can also follow our latest news through Google News for faster and more reliable access to information. For an easy and secure trading experience, download the best crypto app from INDODAX on the App Store or Google Play Store.

Maximize your crypto assets with the INDODAX Earn feature, a practical way to earn passive income from your holdings.

Also follow our social media here: Instagram, X, Youtube & Telegram

FAQ

1.What triggers a long squeeze in crypto?

A long squeeze is usually triggered by a combination of rapid price declines, negative news, or large sell-offs by whales. Traders using high leverage are even more vulnerable because they can be subject to margin calls and forced to sell, further plunging prices.

2.Can a long squeeze be predicted?

It’s difficult to predict with certainty, but there are early indicators. For example, excessively high open interest in long positions, extremely positive funding rates, or liquidation cluster data from Coinglass piling up at a certain price level. All of these can be signs of potentially significant selling pressure.

3.Which is more dangerous: a long squeeze or a short squeeze?

Both are dangerous depending on the trader’s position. Long squeezes are more common in the crypto market because many people tend to hold long positions. Short squeezes are rare, but when they occur, they can cause prices to skyrocket and force short sellers to suffer significant losses.

4.How can beginner traders avoid them?

Beginner traders can reduce the risk of a long squeeze by not using excessive leverage, always setting stop-losses, and monitoring market sentiment and major liquidation levels.

For spot investors, a dollar-cost averaging (DCA) strategy may be safer than trading on margin.

Author: Boy

Polkadot 9.23%

Polkadot 9.23%

BNB 0.47%

BNB 0.47%

Solana 4.89%

Solana 4.89%

Ethereum 2.37%

Ethereum 2.37%

Cardano 1.22%

Cardano 1.22%

Polygon Ecosystem Token 2.16%

Polygon Ecosystem Token 2.16%

Tron 2.83%

Tron 2.83%

Market

Market