Dragonfly doji is a handy candlestick pattern for traders. This candle pattern will help traders see the existence of support and demand.

So, to learn more about a doji candle and how to use this one-candle pattern, let’s see the full review below.

What Is the Dragonfly Doji?

Doji is a Japanese term meaning “mistake” (“blunder”). It refers to the scarcity of opening and closing prices that have something in common.

Meanwhile, the dragonfly doji candlestick is a trendy type of candlestick among traders.

The dragonfly doji is used to find information on a trend reversal.

As mentioned, this candlestick will form when the opening and closing prices are almost balanced for a certain period.

Typically, this candle pattern will indicate a price reversal of a trend in the market.

How To Use Dragonfly Doji?

Regarding how to use it, a doji candle usually provides a moment of “pause and reflection” for traders.

This is because the doji is known as a “neutral pattern.” In this case, if the market is in an uptrend when this pattern appears, it indicates that buying momentum is slowing down or selling momentum is starting to increase.

Investors can see this moment as a sign to get out of the trading trend.

However, it is essential to consider candle formations and confirm with other candlestick patterns.

The trader can exit the trade if he believes the exit indicator/strategy confirms what the doji candle indicates.

Therefore, before exiting a position, it is essential to thoroughly analyze other candlesticks that accompany the presence of a doji candle.

Difference between Dragonfly Doji and Gravestone Doji

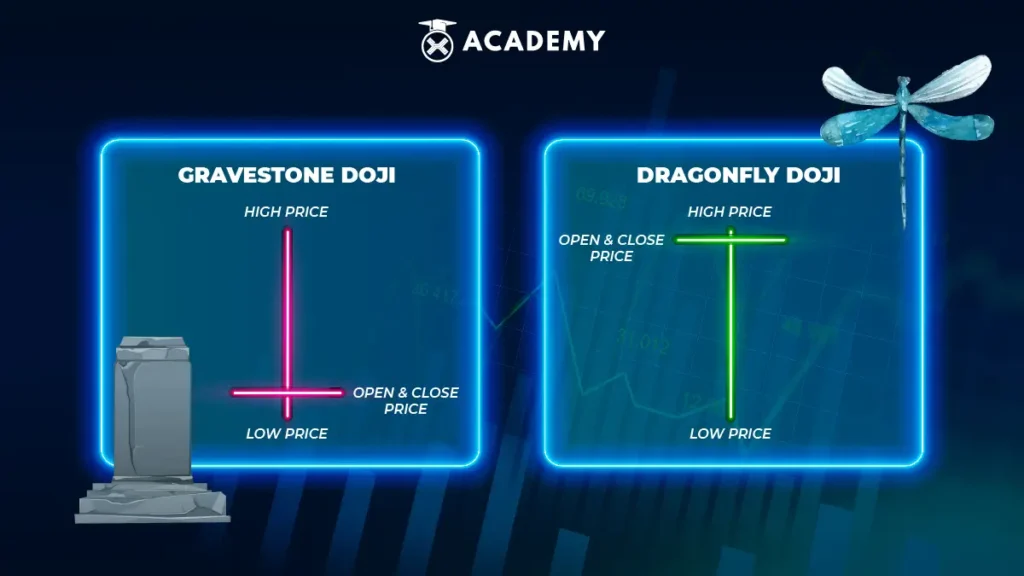

The difference between the dragonfly doji and gravestone doji can be seen first in their shape.

It is known the dragonfly is formed at the bottom when the opening and closing are at the same price and have a long tail.

The tail appears when the price opens at a high and then drops to a low due to a lot of selling.

However, this position lasted only a short time due to increased demand until it was closed in the same position as the price at the opening time.

Conversely, at the gravestone, the price opened in a low position and briefly rose, then dropped again to a subordinate position where it was initially closed and thus formed a tail that extended upwards.

Another difference on the dragonfly doji when it forms at a support level or its bottom will indicate that there will be a reversal towards an increase.

Moments like that then become the right time for traders to take buying actions.

At gravestone, what happened was a price decrease (bearish) from before, which tended to rise.

If this pattern is formed, traders should take profit to secure profits because there will be a decline in the future.

Then, the dragonfly is usually preceded by a downtrend which indicates a reversal will occur—meaning, in the future, there will be bullish.

In the gravestone pattern, which is preceded by an uptrend, a reversal will occur, leading to a bearish or, in the future, decline.

Limitations of Using the Dragonfly Doji

Although it dramatically helps traders, the dragonfly doji is unreliable for spotting most price reversals.

Besides, even though this doji can see this, this candle pattern is unreliable.

That’s because there is no guarantee that the price will continue to move in the expected direction after the confirmation candlestick.

Sometimes, the size of the dragonfly doji plus the size of the confirmation candle can mean that the entry point for a trade is far from the location of the stop loss.

This means traders need to find another location to stop losses, or they may need to stop trading.

Furthermore, it can be challenging to predict the potential profit from trading this doji as these candles generally do not provide a price target.

Conclusion

In conclusion, the dragonfly doji is a candlestick pattern popular among traders, which functions to find information on a trend reversal.

This candlestick will form when the open and close prices are almost identical for a specific period.

This candle pattern will usually indicate a price reversal in a trend in the market.

So, now you know what a dragonfly doji is and how to use it?

Apart from doji candles, you can also learn accurate candlestick patterns to reversal candlestick patterns at Indodax Academy.

After understanding the various candlestick patterns, let’s invest in crypto assets.

However, before starting the investment, checking the price movements of crypto assets on the INDODAX Market is a good idea. Good luck!