Crypto Institutional Appeal is growing.

The belief of crypto being an uncorrelated asset class may be fading, but it does not seem to be deterring interest from traditional finance and tech institutions. The main players in crypto are evolving and there are signs that institutional demand continues to grow even if it is not reflected in prices.

Broad interest from multi-billion institutions arguably began in 2020 and is not showing signs of slowing down.

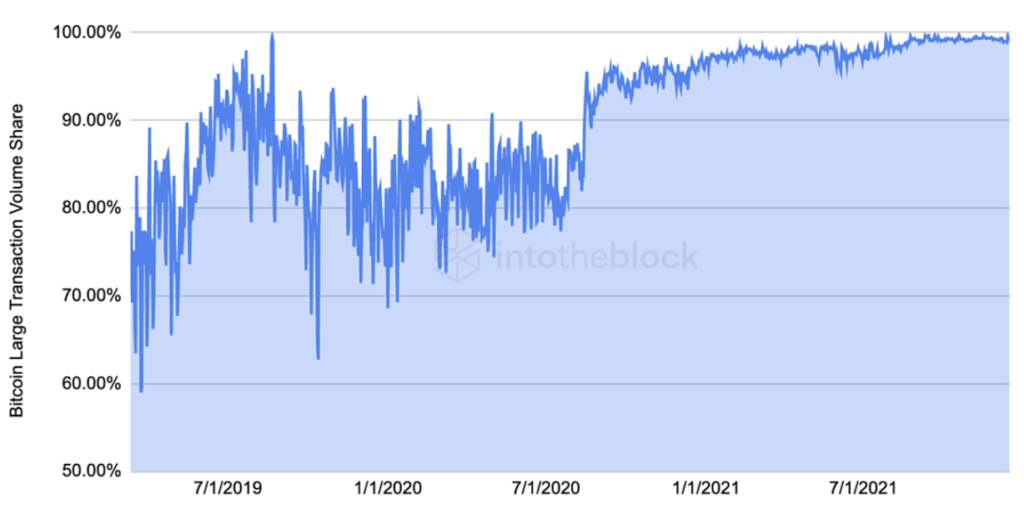

https://app.intotheblock.com/coin/BTC/deep-dive?group=financials&chart=largeTransactions

99% — Currently over 99% of all Bitcoin volume comes from transactions of over $100k, dubbed as large transactions by IntoTheBlock.

The dominance of institutions and change in market structure accelerated in Q3 2020

Since then, the share that large transactions volume has consistently remained above 90%. And as the dominance by institutional investors has been increasing, it could be having effects in on-chain data.

Via IntoTheBlock’s Bitcoin network indicators

Record Holders — The number of addresses holding crypto continues setting new records:

- Bitcoin addresses with a balance reached a record of nearly 40 million

- Addresses holding Ether have outpaced this, with over 70 million having a positive balance of the smart contract platform’s native token

- As the demand-side continues to strengthen, the supply-side of crypto is becoming less relevant.

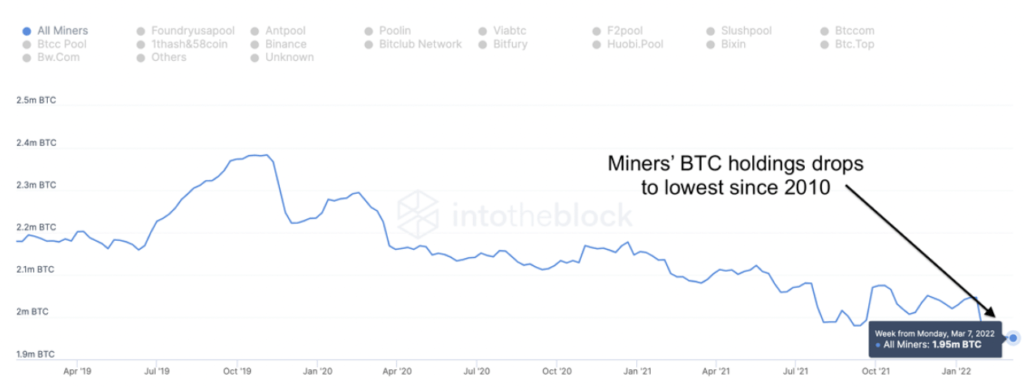

Via IntoTheBlock’s Bitcoin mining metrics

Changing dynamics — crypto is evolving and miners are having a smaller role in it

- The amount of BTC held by miners reached a 10-year low

- Bitcoin hash rate is near record levels, while prices have dropped

- Both of these put pressure on miners’ margins, likely resulting in miners selling part of their holdings to cover operational expenses

- No reason to panic — even if miners appear to be selling, they only less than 1% of the total Bitcoin volume traded.

While miners have faded into irrelevance in terms of their market impact, institutions (and even nation-states) are playing a larger and larger role in crypto.

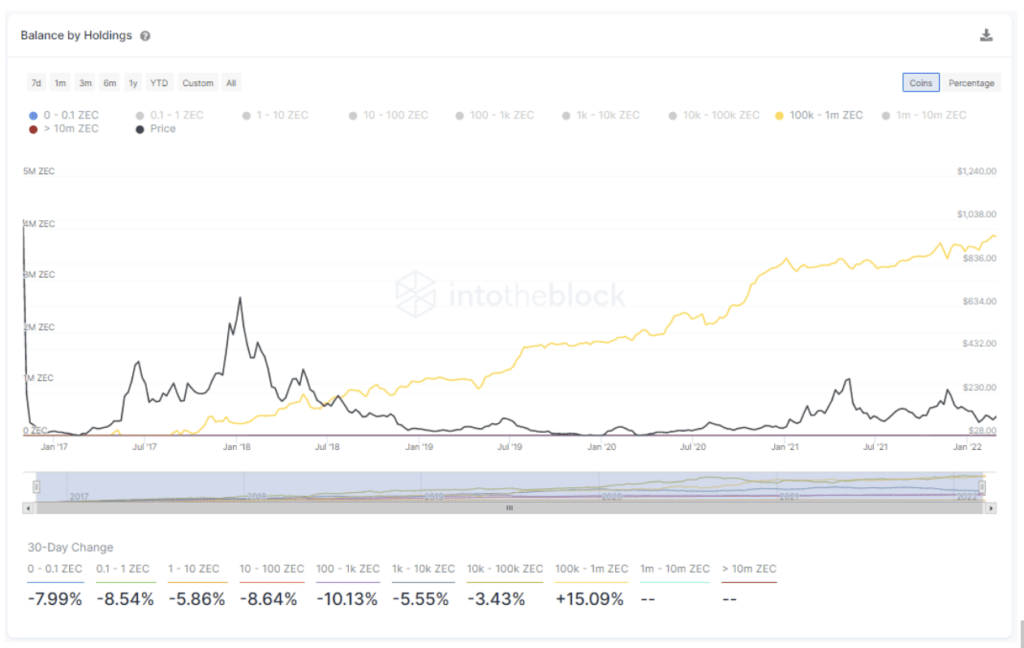

Analyzing ZEC:

The surge in the price of protocols like Monero or ZCash comes in as a result of the recurrent sanctions and increasing regulatory concerns in the market.

ZCash has been one of the biggest winners in this market. As one of the pioneers in using zero-knowledge proof technology, it allows the users to perform transactions through shielded addresses, in which these transactions are verified without revealing the sender, receiver, or transaction amount.

ZEC accumulation – alongside the rise in price, we have spotted some clear patterns of accumulation.

- Addresses holding between 100k-1m ZEC, increasing by 15.09% in the last month and recently reaching a new high of 3.87m ZEC held by these addresses.

Analyzing Ethereum :

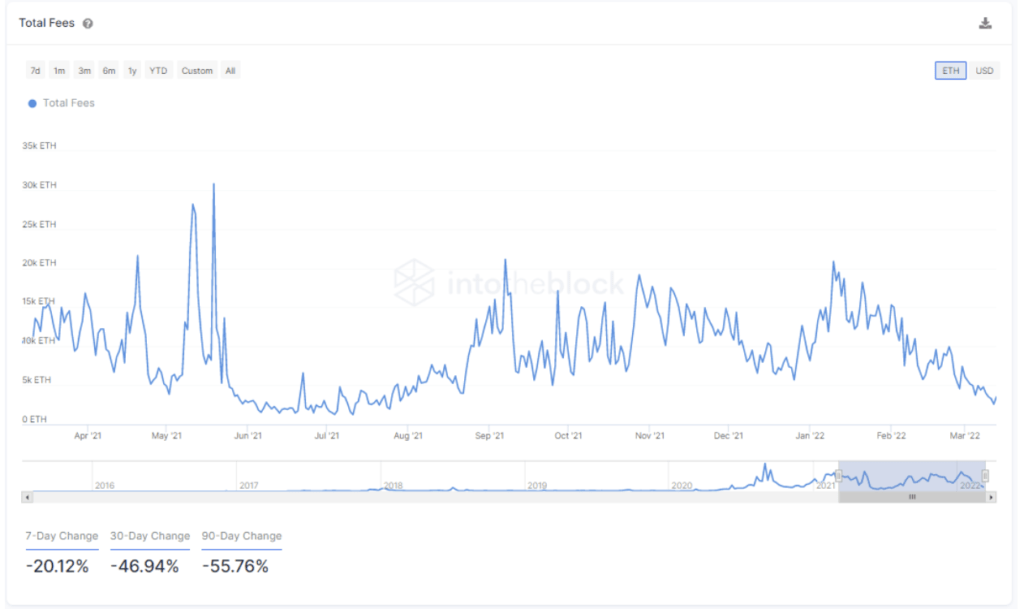

Via IntoTheBlock’s Ethereum network indicators

6-Month Low — Ethereum’s revenue dropped sharply as network demand stalls.

- This is a common pattern where fees drop sharply following large corrections

- NFT activity had kept network activity relatively high, but as volumes declined recently, so did Ethereum fees

- These fees can be seen as Ethereum’s earnings as most of the ETH used here is burnt, analogous to the network’s dividend